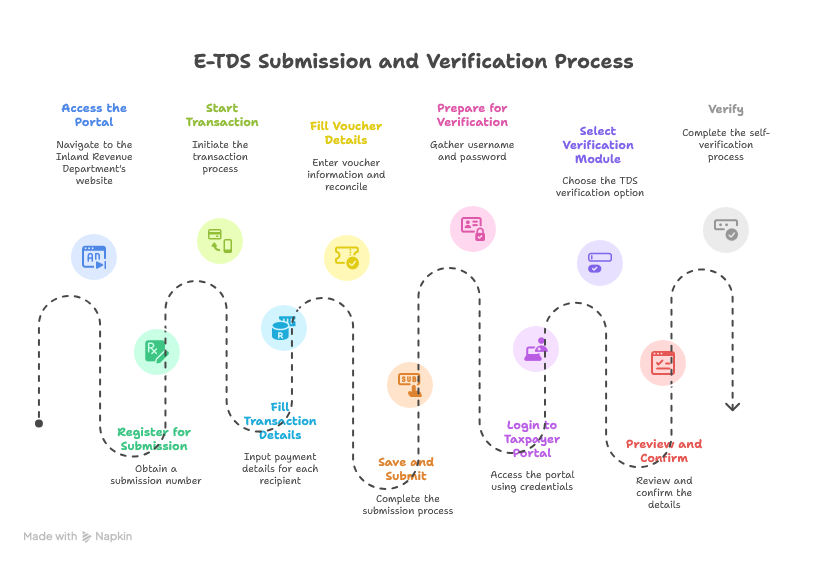

Steps for E-TDS Submission

Steps for E-TDS Submission

- Access the Portal

- Open browser and go to www.ird.gov.np

- Click "Taxpayer Portal"

- Click the "+" next to "E-TDS" on the left panel

- Select "E-TDS"

- Register for Submission

- Click "Register" to get the submission number

- Start Transaction

- Click "Transaction"

- Fill Transaction Details

- Enter details: PAN, Payment Date, Payment Amount, TDS Amount, TDS Type

- Add separately for each recipient

- Click "Save"

- Option: Download sample Excel, fill details, upload with "Load Excel File"

- Fill Voucher Details

- Enter: Revenue Heading, Voucher Number Type (e.g., Bank), Deposit Date, Bank Name, TDS Amount

- Click "Add"

- Enter all vouchers one by one

- Ensure voucher status shows "Reconciled"

- If "Not Reconciled": → Go to www.ird.gov.np → Taxpayer Portal → General → Payment Voucher Search → Search using Deposit Slip No., Voucher Date, or Amount

- Save and Submit

- Return to the transaction form

- Click "Save and Submit"

- Note and keep the generated submission number safe

E-TDS Self-Verification Process

- Prepare for Verification

- Username and Password required

- If not created: go to www.ird.gov.np → Taxpayer Portal → General → Create Password

- W-PAN holders: Get credentials from Inland Revenue Office

- Login to Taxpayer Portal

- Open www.ird.gov.np

- Click "Taxpayer Portal"

- Expand "+" next to "General"

- Select "Taxpayer Log in"

- Login with PAN, Username (PAN itself), and Password

- Select Verification Module

- Go to "Verification"

- Select "TDS"

- W-PAN holders: Use "TDS Verification"

- Preview and Confirm

- Enter the submission number

- Click "Preview" and check details

- Verify

- Click "Verify" to complete the process