NEPSE stands for the Nepal Stock Exchange. It is the only stock exchange in Nepal, established in 1993. NEPSE provides a platform for trading in the shares of publicly listed companies, government bonds, and other securities in Nepal. It plays a crucial role in the Nepalese financial market by facilitating capital formation, providing liquidity to investors, and promoting transparency in securities trading.

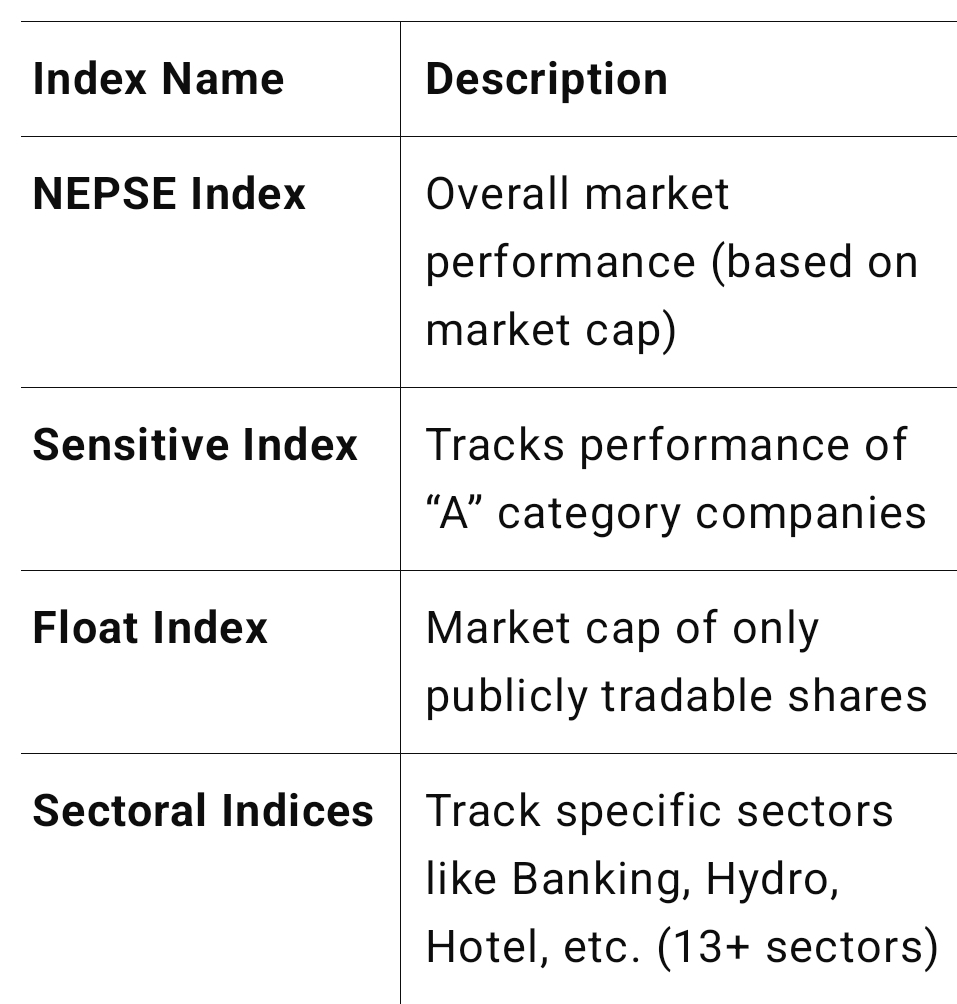

Four Indices of NEPSE Nepal:

NEPSE calculates several indices to represent the performance of different segments of the stock market. Here are four important indices:

NEPSE Index: This is the benchmark index of the Nepal Stock Exchange. It is a market capitalization-weighted index that reflects the overall performance of all listed companies on NEPSE. The index value indicates the fluctuation in the total market capitalization of these companies. Companies with larger market capitalization have a greater influence on the index.

Sensitive Index: This index tracks the performance of the shares of "A" group companies. These are generally considered to be the bluest-chip companies with strong fundamentals and higher liquidity. The Sensitive Index is often seen as a gauge of the performance of the most established and actively traded stocks in the market.

Float Index: This index measures the performance of the float shares of all listed companies. Float shares are the portion of a company's outstanding shares that are available for trading in the open market (i.e., excluding shares held by promoters and other restricted parties). This index aims to provide a more accurate picture of the market's freely tradable portion.

Sensitive Float Index: This index combines the criteria of the Sensitive Index and the Float Index. It tracks the performance of the float shares of the "A" group companies. This index focuses on the actively traded portion of the most prominent companies in the market.

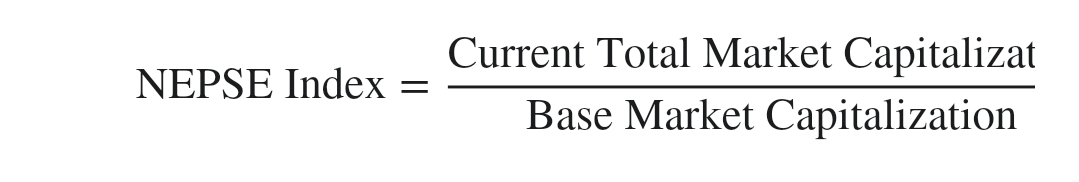

How NEPSE Index is Generated:

The NEPSE Index is calculated using the market capitalization-weighted method. The formula is as follows:

NEPSE = (Current Market Cap / Base Market Cap) × 100

Where:

Current Total Market Capitalization is the sum of the market capitalization of all listed companies at a specific point in time. The market capitalization of a company is calculated by multiplying its current market price per share by the total number of its outstanding shares.

Base Market Capitalization is the total market capitalization of all listed companies on a specific base date (currently, the base year is 1994). This acts as a starting point for the index.

The result is then multiplied by 100 to set a base value for the index. The index is continuously updated as the prices of the listed shares fluctuate throughout the trading day.

Adjustments are made to the base market capitalization to account for events like stock splits, bonus issues, and rights issues to ensure the index reflects pure price changes rather than changes in the number of listed shares.

How to Read NEPSE and Its Indicators:

Reading the NEPSE index and its indicators involves understanding what they represent and how they change over time:

NEPSE Index Value: The absolute value of the NEPSE index (e.g., 2,673.69 as of May 7, 2025) indicates the current level of the overall stock market relative to its base value. A higher value signifies an overall increase in the market capitalization of listed companies, suggesting a bullish (upward) trend in the market. Conversely, a lower value indicates a decrease in overall market capitalization, suggesting a bearish (downward) trend.

Point Change: This shows the absolute change in the index value from the previous trading day's closing. A positive point change indicates that the market has gained points, while a negative change indicates a loss.

Percentage Change: This shows the percentage change in the index value from the previous trading day's closing. It provides a relative measure of the market's movement, making it easier to compare changes over different periods.

Sub-Indices: The various sub-indices (like Banking, Hydropower, Finance, etc.) track the performance of specific sectors of the economy. By observing the movement of these sub-indices, investors can gain insights into the performance of different industries. For example, a significant rise in the Hydropower index might indicate positive sentiment or growth in the hydropower sector.

Turnover (Volume): This represents the total value of shares traded during a specific period. Higher turnover generally indicates greater market activity and liquidity, which can lend more significance to the index movements. Low turnover might suggest less conviction behind the price movements.

Technical Indicators: Besides the main indices, various technical indicators are used to analyze NEPSE data and predict future price movements. These include Moving Averages, Relative Strength Index (RSI), MACD, Bollinger Bands, etc. These indicators help in identifying trends, overbought or oversold conditions, and potential buy or sell signals.

By monitoring the NEPSE index, its various sub-indices, and related indicators, investors can get a broad understanding of the Nepalese stock market's health, identify potential investment opportunities and risks, and make more informed decisions.

Market Participants:

Understanding who the key players are in the NEPSE ecosystem can provide valuable context:

Investors: These can range from individual retail investors to large institutional investors like mutual funds, insurance companies, and pension funds. Their collective buying and selling activities drive market movements.

Listed Companies: These are the public companies whose shares are traded on NEPSE. Their financial performance, corporate actions (like dividends, bonus shares), and future outlook significantly impact their stock prices and, consequently, the overall indices.

Stockbrokers: These are licensed intermediaries that facilitate buying and selling of securities on behalf of investors. They provide trading platforms, research, and advisory services.

Merchant Bankers: These institutions manage Initial Public Offerings (IPOs), Further Public Offerings (FPOs), and provide other financial advisory services to companies.

Depository Participants (DPs): These entities provide dematerialization (demat) services, allowing investors to hold securities in electronic form. They play a crucial role in the smooth settlement of trades.

Securities Board of Nepal (SEBON): This is the regulatory body that oversees NEPSE and the entire securities market in Nepal. SEBON's role is to protect investors, ensure fair market practices, and promote the development of the capital market.

Factors Influencing NEPSE:

Numerous factors can influence the performance of NEPSE and its indices:

Macroeconomic Factors: Overall economic growth (GDP), inflation rates, interest rates, exchange rates, government policies, and political stability all have a significant impact on investor sentiment and corporate profitability, thereby affecting the stock market.

Company-Specific Factors: The financial health, earnings reports, future prospects, management decisions, and any significant news related to individual listed companies can cause their stock prices to fluctuate.

Global Market Trends: International stock market movements, particularly in neighboring countries like India, can sometimes influence investor sentiment and trading activity in NEPSE.

Investor Sentiment: The overall mood and expectations of investors play a crucial role. Optimism and confidence tend to drive buying, pushing prices up, while pessimism and fear can lead to selling pressure.

Liquidity: The availability of funds for trading in the market affects price volatility. Higher liquidity generally leads to more stable price movements.

Regulatory Changes: Any new regulations or changes in existing rules by SEBON can impact market dynamics and investor behavior.

Seasonal Effects: Certain sectors might experience seasonal fluctuations in their performance, which can be reflected in their respective sub-indices.

Using NEPSE Data for Investment Decisions (General Considerations):

While NEPSE indices and indicators provide valuable insights, it's crucial to understand their limitations and use them judiciously:

The NEPSE index reflects the overall market trend but doesn't guarantee the performance of individual stocks. Thorough fundamental and technical analysis of individual companies is essential before making investment decisions.

Past performance is not necessarily indicative of future results. Market conditions and influencing factors can change rapidly.

Consider your risk tolerance and investment goals. Different investors have different financial situations and objectives, so a one-size-fits-all approach to investing based solely on index movements is not advisable.

Diversification is key. Spreading investments across different sectors and asset classes can help mitigate risk.

Stay informed. Keep abreast of economic news, company announcements, and market developments that could impact your investments.

Further Exploration:

To deepen your understanding, you might want to explore:

Historical NEPSE data: Analyzing past trends and patterns can provide context for current market movements.

Financial statements of listed companies: Understanding a company's financial health is crucial for fundamental analysis.

Technical analysis tools and techniques: Learning about charts, patterns, and indicators can aid in identifying potential trading opportunities and risks.

Resources provided by NEPSE and SEBON: Their official websites often contain valuable information, reports, and educational materials.

Basic Concepts:

Share (or Stock/Equity): Represents a unit of ownership in a company. When you buy shares, you become a part-owner.

Stock Market: A marketplace where buyers and sellers trade shares of publicly listed companies. NEPSE is the stock market of Nepal.

Index: A statistical measure that tracks the performance of a group of stocks, like the NEPSE Index or its sub-indices.

Market Capitalization (Market Cap): The total market value of a company's outstanding shares, calculated by multiplying the current share price by the total number of shares. It indicates the size of the company.

Large-Cap: Companies with large market capitalization.

Mid-Cap: Companies with medium market capitalization.

Small-Cap: Companies with small market capitalization.

Liquidity: How easily an asset (like a stock) can be bought or sold in the market without significantly affecting its price. Highly liquid stocks have many buyers and sellers.

Volatility: The degree of price fluctuations in a stock or the market. High volatility means prices can change rapidly and significantly.

Trading Terms:

Bid Price: The highest price a buyer is willing to pay for a stock at a given time.

Ask Price (or Offer Price): The lowest price a seller is willing to accept for a stock at a given time.

Bid-Ask Spread: The difference between the bid price and the ask price. A narrow spread usually indicates higher liquidity.

Volume: The total number of shares traded during a specific period (e.g., a day). High volume often suggests strong interest in a stock.

Market Order: An order to buy or sell a stock immediately at the best available current market price.

Limit Order: An order to buy or sell a stock at a specific price or better. A buy limit order will only execute at or below the specified price, and a sell limit order will only execute at or above the specified price.

Broker: A firm or individual that facilitates the buying and selling of securities on behalf of investors.

Trading Account (Demat Account): An account used to hold shares in electronic form and to execute trades. In Nepal, this is typically a Dematerialized (Demat) account.

Intraday Trading: Buying and selling stocks within the same trading day, aiming to profit from short-term price movements.

Delivery Trading: Buying stocks with the intention of holding them for more than one trading day.

Market Trends and Conditions:

Bull Market: A period of rising stock prices and overall optimism in the market.

Bear Market: A period of declining stock prices and overall pessimism in the market.

Uptrend: A general direction of increasing prices over time.

Downtrend: A general direction of decreasing prices over time.

Sideways Trend: A period where prices fluctuate within a relatively narrow range without a clear upward or downward direction.

Company Performance and Valuation:

Earnings Per Share (EPS): A company's profit divided by its number of outstanding shares, indicating its profitability on a per-share basis.

Dividend: A portion of a company's profits distributed to its shareholders, usually on a per-share basis.

Dividend Yield: The annual dividend payment as a percentage of the current stock price.

Price-to-Earnings Ratio (P/E Ratio): A valuation ratio comparing a company's stock price to its earnings per share. It can indicate whether a stock is overvalued or undervalued relative to its earnings.

Other Important Terms:

Initial Public Offering (IPO): The first time a private company offers its shares to the public to raise capital.

Secondary Market: The market where previously issued securities (like stocks) are bought and sold (i.e., after the IPO). NEPSE is a secondary market.

Portfolio: A collection of different investments held by an individual or institution.

Sector: A group of companies that operate in the same industry (e.g., Banking Sector, Hydropower Sector on NEPSE).

Fundamental Analysis: A method of evaluating stocks by analyzing a company's financial health, earnings, assets, and future prospects.

Technical Analysis: A method of evaluating stocks by studying historical price patterns and trading volume to predict future price movements.

Stop-Loss Order: An order to sell a stock if it reaches a certain price, designed to limit potential losses.

Margin: Borrowing money from a broker to buy stocks, which can amplify both gains and losses.

Short Selling: Borrowing shares and selling them in the hope of buying them back later at a lower price to profit from a price decline.

Bonus Shares: Additional shares issued to existing shareholders for free, usually out of the company's accumulated profits.

Rights Issue: An offering of new shares to existing shareholders at a discounted price, usually to raise additional capital.

Circuit Breaker: A mechanism used by stock exchanges like NEPSE to temporarily halt trading during periods of extreme price volatility to allow for order reassessment and prevent panic selling.

This is not an exhaustive list, but it covers many of the essential terminologies you'll encounter in the stock market, particularly within the context of NEPSE. As you continue to learn and engage with the market, you'll naturally become more familiar with these and other terms.