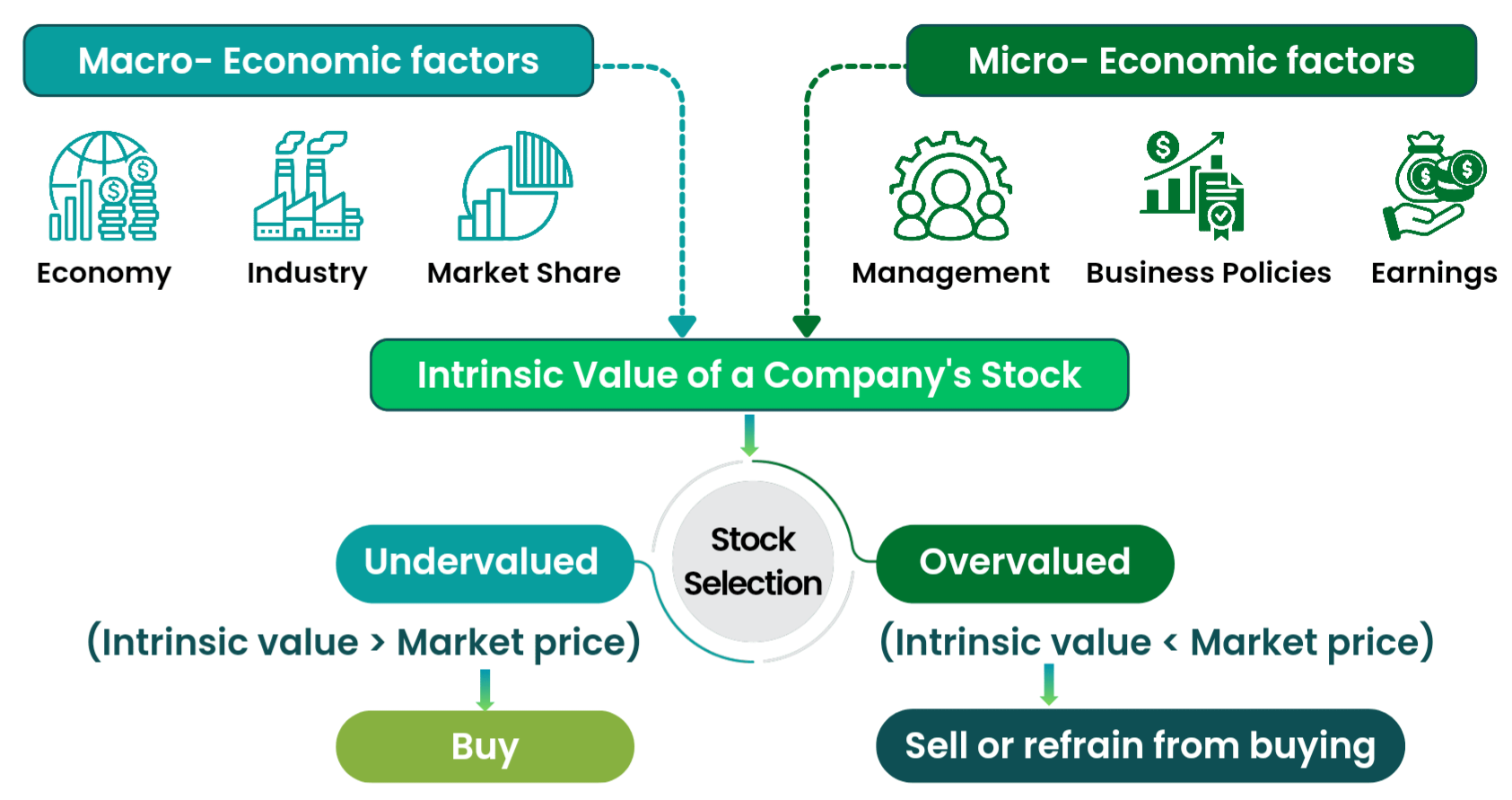

Fundamental analysis is a method used to evaluate a stock's intrinsic value by examining the financial health of a company, industry conditions, and macroeconomic factors. It helps investors determine whether a stock is undervalued or overvalued and provides insights for long-term investment decisions.

Key Components of Fundamental Analysis

- Qualitative Factors:

Business Model: Understand how the company generates revenue and its competitive advantages, such as brand strength, patents, or market share.

Management Quality: Evaluate the leadership team’s track record, vision, and ability to drive growth.

Industry Position: Assess the company’s standing relative to competitors and its ability to adapt to market trends.

Macroeconomic Environment: Consider external factors like economic growth, inflation, interest rates, and government policies that may impact the company.

- Quantitative Factors:

Financial Statements:

Income Statement: Analyzes profitability through metrics like revenue, gross margin, and net income.

Balance Sheet: Examines financial stability via assets, liabilities, and equity, along with ratios like debt-to-equity and current ratio.

Cash Flow Statement: Focuses on cash inflows and outflows, especially operating and free cash flow, to evaluate liquidity and sustainability.

Financial Ratios:

Profitability Ratios: Return on Equity (ROE) and Net Profit Margin measure efficiency and earnings relative to revenue or equity.

Valuation Ratios: Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios compare market price to earnings or book value.

Leverage and Efficiency Ratios: Debt-to-Equity and Inventory Turnover assess debt levels and operational efficiency.

- Intrinsic Valuation:

Discounted Cash Flow (DCF): Estimates the present value of future cash flows to calculate the intrinsic value.

Dividend Discount Model (DDM): Values a company based on expected future dividends, ideal for dividend-paying stocks.

Earnings Power Value (EPV): Measures the ability to generate profits without growth assumptions.

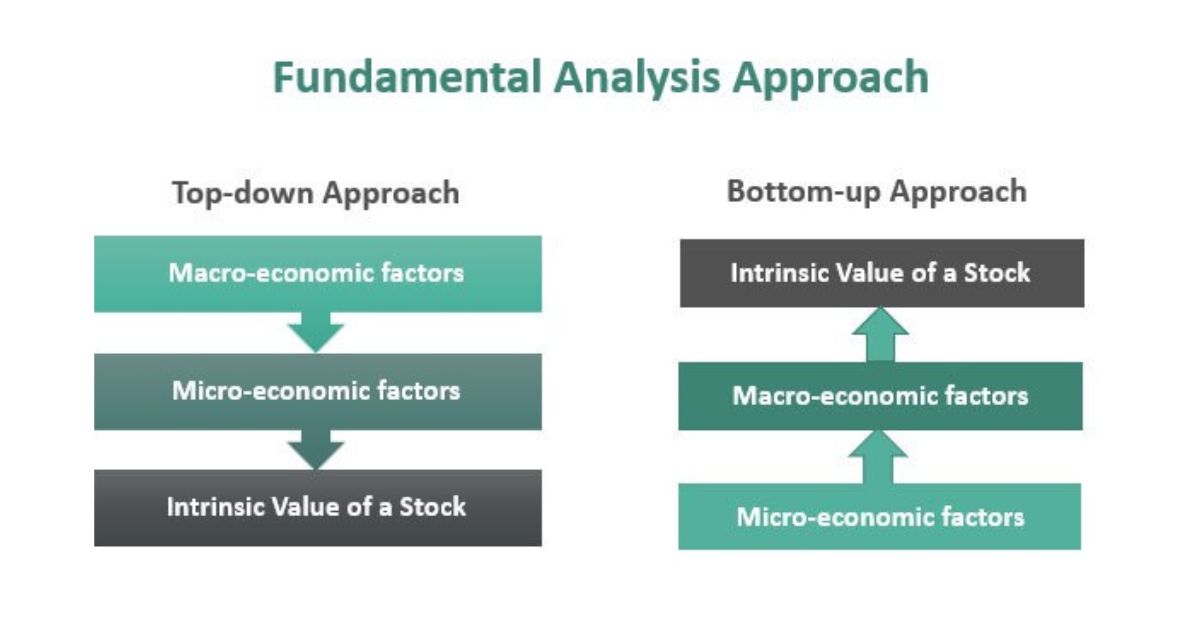

Steps in Fundamental Analysis

Study the industry and competitive landscape.

Analyze the company’s business model, strengths, and risks.

Review financial statements and calculate ratios to gauge profitability, liquidity, and efficiency.

Use valuation models like DCF or P/E comparisons to assess intrinsic value.

Evaluate risks, such as market competition, debt levels, or regulatory changes.

Compare intrinsic value with the current market price to decide whether the stock is undervalued (buy) or overvalued (sell).

Advantages and Limitations

Advantages: Provides a long-term perspective, reduces emotional trading, and helps identify undervalued opportunities. Limitations: Time-intensive, relies on accurate data, and may not capture short-term price movements.

In summary, fundamental analysis combines financial data, industry trends, and economic factors to assess a stock’s true value. It is a critical tool for long-term investors seeking sustainable growth.