Transfer pricing (TP) is the process of setting prices for goods, services, and intangibles sold between related companies within the same multinational group. The purpose of transfer pricing is to properly allocate a multinational enterprise's (MNE's) profits and expenses among its different legal entities in different countries. This is crucial for tax purposes, as each country has its own tax laws and rates.

Transfer pricing is the practice of setting prices for goods and services exchanged between related companies to ensure transactions are at an arm's length, which is crucial for fair profit allocation and taxation among different countries.

The main reason transfer pricing is required is to ensure that transactions between associated persons are conducted at an "arm's length" price. The arm's length principle, the global standard for transfer pricing, states that the price of a controlled transaction should be the same as if it had occurred between two unrelated, independent parties in a comparable transaction. This prevents MNEs from manipulating prices to shift profits from high-tax jurisdictions to low-tax jurisdictions to reduce their overall tax liability.

Calculation and Impact on Accounting, Financial Reporting, and Taxation

Calculation

The calculation of transfer prices is not a simple formula but a process of a "comparability analysis". This analysis involves finding comparable uncontrolled transactions (transactions between independent parties) to determine an arm's length price or a range of arm's length prices. The OECD Transfer Pricing Guidelines outline several methods to achieve this, categorized as traditional transaction methods and transactional profit methods.

Traditional Transaction Methods: These methods directly compare the price or profit of a controlled transaction to a comparable uncontrolled transaction. They are generally preferred as they are considered more direct and reliable.

Comparable Uncontrolled Price (CUP) Method: This is the most direct and reliable method. It compares the price charged in a controlled transaction to the price charged in a comparable uncontrolled transaction.

Resale Price Method (RPM): This method is used for transactions involving distributors or resellers. It starts with the price at which a reseller sells a product to an independent third party and then deducts an appropriate gross margin to arrive at an arm's length price for the original transaction.

Cost-Plus Method (CPM): This method starts with the costs incurred by the supplier in a controlled transaction and adds a mark-up to determine the arm's length price. The mark-up should be one that an independent party would earn in a similar transaction.

Transactional Profit Methods: These methods examine the profits from a controlled transaction and compare them to the profits of comparable independent companies. They are used when traditional methods are not reliable or cannot be applied.

Transactional Net Margin Method (TNMM): This method examines the net profit margin a taxpayer earns from a controlled transaction and compares it to the net profit margin of comparable uncontrolled transactions. This is the most common method used in practice.

Profit Split Method (PSM): This method is used when two or more associated enterprises are highly integrated and contribute significant and unique value to a transaction. The combined profits from the controlled transaction are split between the associated enterprises based on an allocation that would have been agreed upon by independent parties.

Impact

Transfer pricing has a significant impact on various aspects of a business.

Accounting and Financial Reporting: The transfer prices set for intercompany transactions directly affect the revenues, costs, and profits recorded in the financial statements of each entity within the group. If the prices are not at arm's length, the financial performance of each subsidiary can be distorted. This can lead to misleading financial ratios and key performance indicators, affecting internal management decisions and external stakeholder perceptions. Tax authorities may require companies to make adjustments to their reported profits for tax purposes, which can result in differences between a company's financial accounting results and its taxable income.

Taxation: This is the most critical area impacted by transfer pricing. MNEs may use transfer pricing to shift profits to low-tax jurisdictions, reducing their global tax burden. However, tax authorities worldwide are increasingly vigilant and have implemented strict regulations and documentation requirements to combat this. If a company's transfer prices are found to be non-compliant with the arm's length principle, tax authorities can adjust the taxable income, leading to additional taxes, interest, and severe penalties. This can also lead to "double taxation", where the same income is taxed in two different countries, as one country's tax authority may increase a company's taxable income while the other does not provide a corresponding adjustment.

Key Terminologies

To understand transfer pricing, it is essential to be familiar with the following terms:

- Arm's Length Principle: The international standard that requires transactions between related parties to be priced as if they were conducted between independent, unrelated parties. This is the cornerstone of transfer pricing.

- Controlled Transaction: A transaction that occurs between two or more associated enterprises (related parties).

- Uncontrolled Transaction: A transaction between two independent, unrelated parties.

- Associated Enterprise: A person (an individual or a company) that is related to another person, such as through common ownership or control.

- Comparability Analysis: The process of identifying and comparing the conditions of controlled and uncontrolled transactions to determine if they are comparable. This involves analyzing the functions performed, assets used, and risks assumed (FAR analysis) by each party.

- Functional Analysis (FAR Analysis): An analysis that examines the Functions performed, Assets used, and Risks assumed by each entity in a controlled transaction. This is a critical step in a comparability analysis.

- Benchmark Study: A study that involves searching for and analyzing data from independent companies to establish an arm's length range of prices or profits.

- Base Erosion and Profit Shifting (BEPS): A term used to describe tax-avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low- or no-tax locations. Transfer pricing is a key area addressed by the OECD's BEPS project.

- Transfer Pricing Documentation: The set of documents and records a taxpayer must maintain to support that their controlled transactions were conducted at arm's length.

Nepal's Perspective: International Taxation, IFRS/NFRS, and Transfer Pricing Guidelines

International Taxation

International taxation in Nepal, as in many countries, is governed by a combination of domestic tax laws (like the Income Tax Act, 2002) and international tax treaties (Double Taxation Avoidance Agreements or DTAAs). The primary goal is to ensure that income earned by a resident of Nepal, as well as income earned by a non-resident in Nepal, is taxed fairly and that double taxation is avoided. Transfer pricing is a critical component of international taxation because it affects how profits are allocated between jurisdictions, influencing the tax base in each country.

IFRS / NFRS

International Financial Reporting Standards (IFRS) and Nepal Financial Reporting Standards (NFRS) are the accounting standards used for financial reporting. While these standards don't directly prescribe the pricing of intercompany transactions, they require companies to disclose information about related party transactions. * IAS 24/NFRS 24 Related Party Disclosures: This standard requires entities to disclose information about their related party relationships, transactions, and outstanding balances. This includes the nature of the relationship, the amount of the transactions, and the pricing policy used. While it doesn't specify how to set the transfer price, it ensures transparency in financial reporting, allowing stakeholders to understand the impact of these transactions. The transfer prices determined for tax purposes must be reflected in the financial statements, impacting the reported revenue, cost of goods sold, and profits.

Transfer Pricing Guidelines of IRD Nepal

The Inland Revenue Department (IRD) of Nepal has a directive on transfer pricing, particularly through Section 33 of the Income Tax Act, 2002. * Section 33, Income Tax Act, 2002: This section empowers the IRD to adjust the income of a person involved in a transaction with an associated person if the transaction is not at arm's length. The IRD can re-allocate income and expenses to reflect a more accurate taxable income. * IRD's Transfer Pricing Directive: The IRD has issued specific guidelines to implement the provisions of the Income Tax Act. These guidelines provide the framework for taxpayers to follow, including: * Applicability: The directive applies to cross-border transactions between associated persons. * Methods: It mandates the use of the arm's length principle and outlines the acceptable methods for determining arm's length prices, similar to the OECD guidelines (CUP, RPM, CPM, TNMM, and PSM). * Documentation: It requires taxpayers to maintain detailed documentation supporting their transfer prices. This includes a Functional Analysis (FAR Analysis), a comparability analysis, and a benchmark study. This documentation is crucial for tax audits. * Advance Pricing Arrangement (APA): The directive also provides for the possibility of an APA, which is a voluntary agreement between the taxpayer and the tax authority on the transfer pricing method to be applied to a set of future transactions over a specific period. This provides certainty and helps prevent disputes.

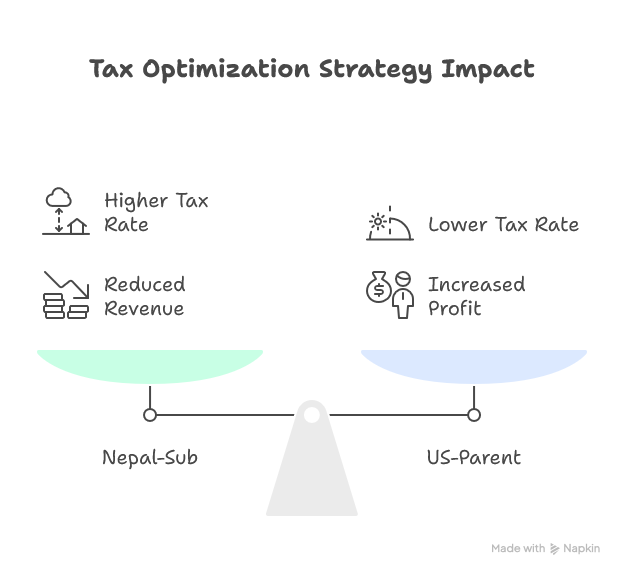

Example Case: A Nepali subsidiary, "Nepal-Sub," manufactures and sells goods to its parent company, "US-Parent," in the USA. The Nepali corporate tax rate is 25%, while the US rate is 21%. To reduce its global tax burden, the US-Parent directs Nepal-Sub to sell the goods at a very low price, say $5 per unit, even though the fair market price for similar goods is $15 per unit.

- Impact: Nepal-Sub's reported profit will be artificially low, resulting in a lower tax payment in Nepal. The US-Parent will have a higher profit, but since the goods are purchased at a low price, the overall tax savings for the MNE group will be significant.

- IRD Intervention: Under the Transfer Pricing Directive, the IRD would conduct an audit. Using a comparability analysis, they would determine that the arm's length price is $15 per unit. The IRD would then adjust Nepal-Sub's taxable income, treating the sale as if it were made at $15 per unit. This would result in Nepal-Sub owing additional taxes, along with potential interest and penalties. The US tax authority might not recognize this adjustment, leading to double taxation on the $10 difference per unit. This is why proper documentation and adherence to the arm's length principle are crucial.