Deferred tax is a method of accounting that reconciles the difference between a company's accounting profit (as per financial statements) and its taxable profit (as per tax laws). It recognizes that taxes paid in one period may relate to income and expenses reported in another. The purpose is to apply the matching principle of accounting, ensuring that the tax expense shown on the income statement matches the income for that period, regardless of when the tax is actually paid.

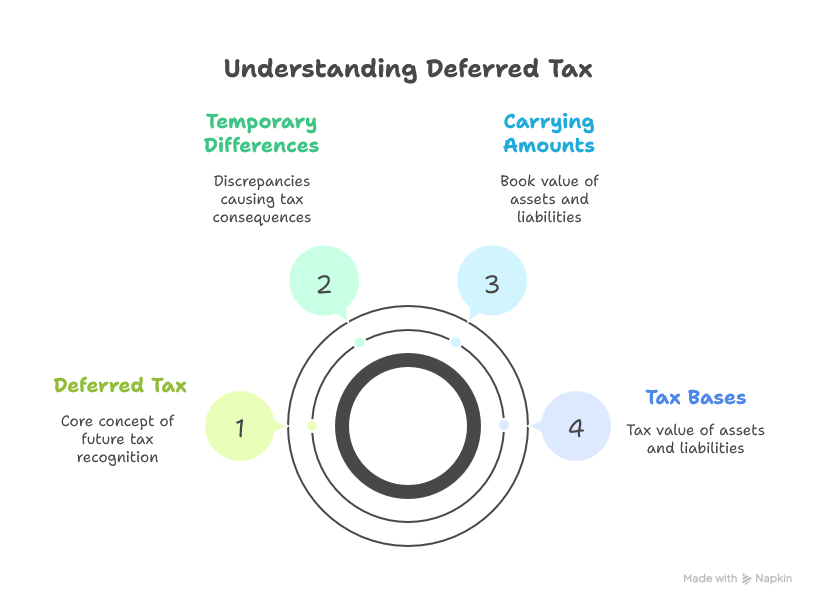

Deferred tax is the accounting process of recognizing future tax consequences that arise from temporary differences between the carrying amounts of assets and liabilities in the financial statements and their corresponding tax bases.

Differences between book profit and taxable profit.

Calculating Deferred Tax

The calculation of deferred tax is based on temporary differences, not permanent ones. The general formula is:

Deferred Tax = (Carrying Amount - Tax Base) x Tax Rate

- Carrying Amount: The value of an asset or liability as shown on the company's balance sheet.

- Tax Base: The value of an asset or liability as determined by the tax authority for tax purposes.

This calculation is done for each temporary difference, and the resulting deferred tax assets (DTA) and deferred tax liabilities (DTL) are then netted against each other, as per accounting standards like IFRS/NFRS.

Temporary vs. Permanent Differences

Differences between accounting profit and taxable profit are categorized as either temporary or permanent.

Temporary Differences: These are timing differences that will reverse in a future period. They arise when the tax treatment of an item of income or expense differs from its accounting treatment. For example, a company might use straight-line depreciation for accounting purposes but accelerated depreciation for tax purposes. The difference in the depreciation amount in any given year is a temporary difference that will reverse over the asset's useful life. Only temporary differences give rise to deferred tax.

Permanent Differences: These are differences between accounting and taxable profit that will never reverse. They arise from items of income or expense that are either included in one calculation but permanently excluded from the other. For instance, fines or penalties are often recorded as an expense in the financial statements but are not tax-deductible. Since this expense will never be deductible for tax purposes, it's a permanent difference and doesn't create deferred tax.

These differences directly impact the current period's profit by causing a disparity between the accounting profit before tax and the taxable income. In future periods, temporary differences reverse, affecting the profit of those periods as well.

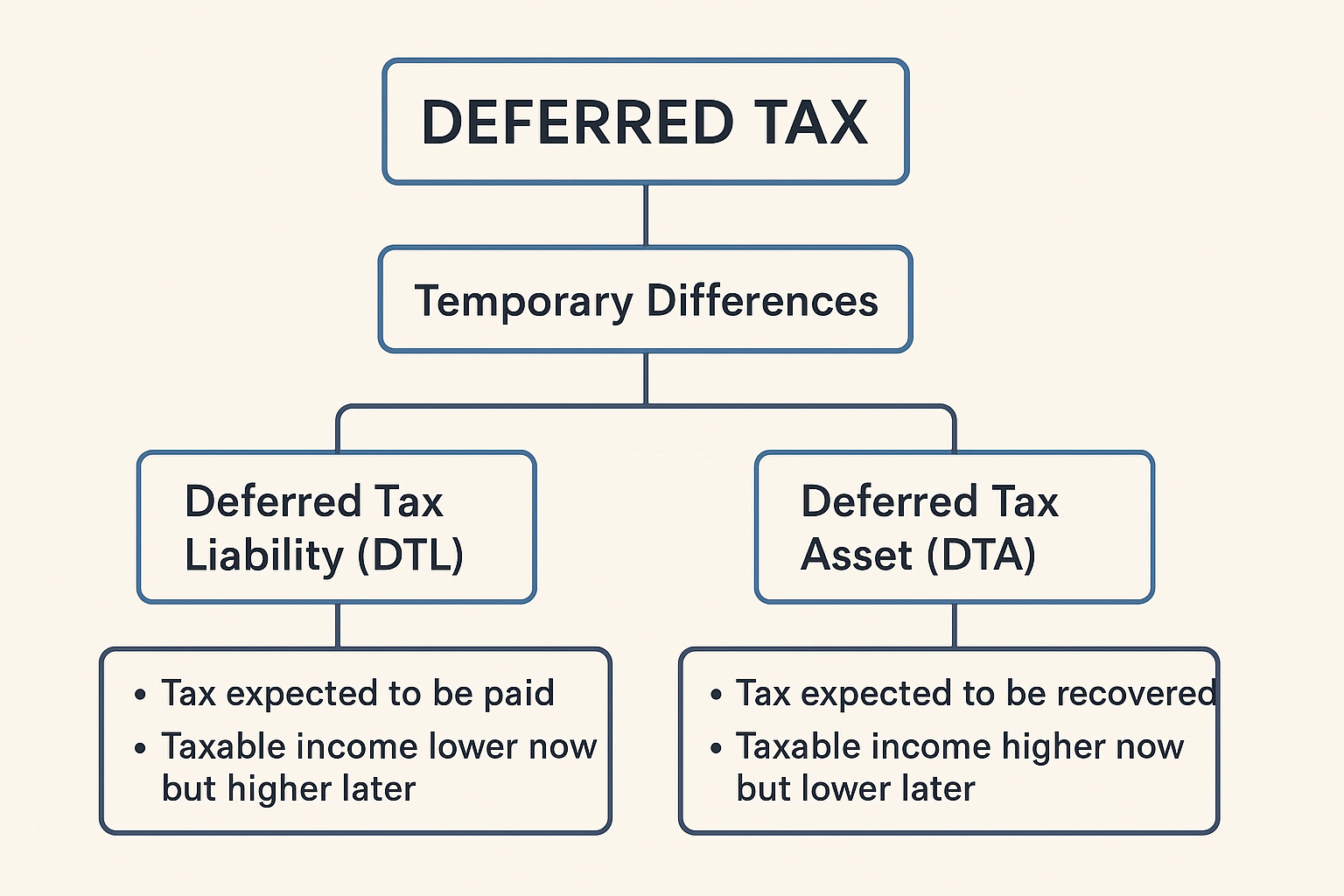

Deferred Tax Assets (DTA) vs. Deferred Tax Liabilities (DTL)

DTA and DTL are two sides of the same coin, both arising from temporary differences but with opposite effects.

Deferred Tax Liability (DTL): This is a future tax obligation. It arises when the taxable profit is greater than the accounting profit in the current period. This means the company is paying less tax now than it will owe in the future. A common example is using accelerated depreciation for tax purposes, which results in a lower taxable income and less tax paid in the early years. The DTL represents the tax that will be paid in the future when the depreciation difference reverses. It's a non-current liability on the balance sheet.

Deferred Tax Asset (DTA): This is a future tax benefit. It arises when the taxable profit is less than the accounting profit in the current period. This implies the company has "prepaid" its taxes. An example is a warranty provision. For accounting purposes, a company can recognize a provision for future warranty costs as an expense. However, tax authorities may only allow the deduction when the cost is actually incurred. The DTA represents the future tax savings the company will receive when the warranty costs are eventually paid and become tax-deductible. It's a non-current asset on the balance sheet. A DTA is only recognized if it is probable that there will be future taxable profit to utilize the asset.

Impact on Financial Statements

Deferred taxes are crucial for providing an accurate and fair view of a company's financial performance.

Income Statement: The income tax expense on the income statement includes two components: current tax expense (the tax payable for the period) and deferred tax expense or credit (the change in DTA or DTL for the period). This ensures that the income tax expense aligns with the accounting profit, providing a more reliable measure of profitability. Without deferred tax, the income statement would be distorted by the timing differences in tax payments.

Balance Sheet: DTA is presented as a non-current asset and DTL as a non-current liability. These balances provide a clear picture of the company's future tax obligations or benefits, which is vital for analysts and investors to assess long-term financial health and cash flow.

Accounting Entries and Example

Accounting standards like IFRS (IAS 12) and Nepal Financial Reporting Standards (NFRS) follow a similar "balance sheet approach" for deferred tax.

Example (Nepal):

A company in Nepal purchases a machine on July 16, 2024, for NPR 1,000,000. * As per NFRS (e.g., NAS 16): The company uses straight-line depreciation over 5 years. Annual depreciation is NPR 200,000. * As per Nepal's Income Tax Act: The machine is in Class B, with a depreciation rate of 25% on a written-down value basis.

Year 1 (2024/25):

- Accounting Depreciation: NPR 1,000,000 / 5 = NPR 200,000

- Tax Depreciation: NPR 1,000,000 * 25% = NPR 250,000

- Temporary Difference: NPR 250,000 (Tax) - NPR 200,000 (Accounting) = NPR 50,000 (Taxable Temporary Difference)

- Why is it a DTL? Taxable income is lower than accounting profit by NPR 50,000, meaning less tax is paid now. The company has a future obligation to pay tax on this difference.

- Calculation: Assuming a tax rate of 25%, DTL = NPR 50,000 * 25% = NPR 12,500

Journal Entry:

- Dr. Income Tax Expense (Deferred) NPR 12,500

- Cr. Deferred Tax Liability NPR 12,500

- (To recognize the deferred tax liability on the temporary difference)

Year 2 (2025/26):

- Accounting Depreciation: NPR 200,000

- Tax Depreciation: (NPR 1,000,000 - NPR 250,000) * 25% = NPR 187,500

- Temporary Difference: NPR 187,500 (Tax) - NPR 200,000 (Accounting) = -NPR 12,500 (Deductible Temporary Difference)

- Why does the DTL decrease? The tax depreciation is now less than the accounting depreciation. The temporary difference is reversing, reducing the future tax obligation.

- Change in DTL: The DTL needs to be adjusted.

- Opening DTL: NPR 12,500

- Change: -NPR 12,500 * 25% = -NPR 3,125

- Closing DTL: NPR 12,500 - NPR 3,125 = NPR 9,375 (this would be the new balance)

Journal Entry:

- Dr. Deferred Tax Liability NPR 3,125

- Cr. Income Tax Expense (Deferred) NPR 3,125

- (To reverse a portion of the deferred tax liability as the temporary difference reverses)

Deferred tax is an accounting method that accounts for the timing differences between a company's financial reporting and its tax reporting, ensuring the tax expense matches the profit it relates to. It arises from temporary differences, which are discrepancies that will reverse over time, unlike permanent differences that never reverse. A deferred tax liability (DTL) is a future tax obligation created when current taxable profit is lower than accounting profit, while a deferred tax asset (DTA) is a future tax benefit when the opposite is true. Calculating deferred tax involves applying the tax rate to these temporary differences, and the resulting DTA and DTL are reported on the balance sheet, providing a more accurate view of a company's long-term financial position and performance.