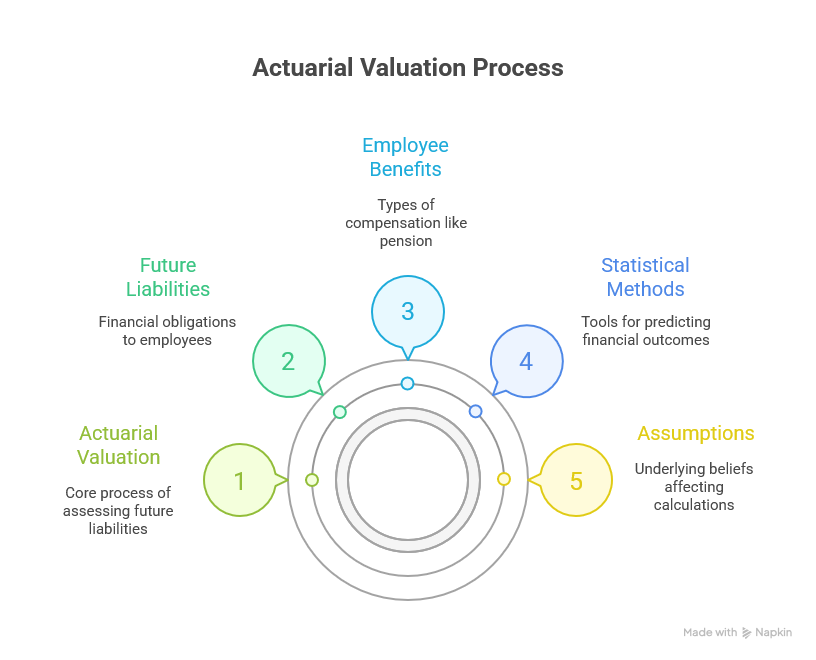

Actuarial valuation is the process of calculating the present value of future liabilities related to employee benefits, such as gratuity, pension, and leave encashment. An actuary uses statistical methods and various assumptions to estimate the financial obligations a company will have to pay its employees in the future.

Why Actuarial Valuation is Required

Actuarial valuation is required under various accounting standards, including the International Financial Reporting Standards (IFRS) and Nepal Financial Reporting Standards (NFRS), to ensure that companies accurately report their long-term employee benefit liabilities.

The relevant standard is IAS 19, Employee Benefits, under IFRS. Similarly, NFRS, which is largely aligned with IFRS, also requires this valuation. The main reason for this requirement is to:

- Provide a True and Fair View: Financial statements must present a true and fair view of a company's financial position. Without actuarial valuation, a company's balance sheet would not reflect the significant long-term liabilities owed to employees.

- Accrual Basis of Accounting: These standards require the recognition of an expense when an employee provides service, even if the payment for that service is due much later. Actuarial valuation helps in quantifying this obligation and recognizing it as a liability and an expense in the financial statements for the current period.

Key Terminologies

To understand actuarial valuation, it's essential to know the following terms:

- Actuarial Assumptions: These are the estimates and predictions about future events that affect the valuation. They are categorized into two types:

- Demographic Assumptions: These relate to employee behavior and life expectancy, such as mortality rates, employee turnover (attrition), retirement age, and disability rates.

- Financial Assumptions: These are economic factors that influence the value of liabilities, including the discount rate, salary growth rate, and inflation rate.

- Actuarial Present Value: The estimated value of all future benefit payments, discounted to their present value as of the valuation date.

- Actuarial Gain or Loss: This is the difference between the actual experience of the plan and what was expected based on the actuarial assumptions. A gain occurs if the liability is lower than anticipated, while a loss occurs if it's higher.

- Defined Benefit Obligation (DBO): This is the present value of the benefits that employees have earned for their service in the current and prior periods.

Actuarial Valuation for Leave Encashment

Leave encashment is a benefit where employees are compensated for their unused leave days. The actuarial valuation process for this benefit involves estimating the company's future liability.

Calculation and Major Components

The calculation of the leave encashment liability is based on the Projected Unit Credit (PUC) method. This method is mandatory under IAS 19. It estimates the final cost of the benefits that employees have earned to date, using actuarial assumptions.

The major components considered in the context of leave encashment valuation are:

- Employee Data: Detailed information on each employee, including their date of joining, date of birth, and current salary.

- Leave Policy: The company's specific rules regarding how leave is earned, accumulated, and whether it can be encashed.

- Financial Assumptions:

- Discount Rate: Used to find the present value of future obligations. A higher rate lowers the liability, and a lower rate increases it.

- Salary Escalation Rate: The projected annual increase in employee salaries, as leave encashment is usually paid at the final salary.

- Demographic Assumptions:

- Attrition/Turnover Rate: The probability that an employee will leave the company before their retirement.

- Leave Utilization Rate: The rate at which employees are expected to utilize their accumulated leave in the future.

Accounting Entries and Impact on Financial Reports

The actuarial valuation has a direct impact on a company's financial statements by creating a provision for the long-term liability.

Accounting Entries

Recognizing the Expense and Liability:

- The actuarial valuation determines the Defined Benefit Obligation (DBO) as of the reporting date.

- The change in this obligation during the year is recognized as a "Leave Encashment Expense" in the Statement of Profit or Loss.

- The corresponding liability is recorded as a "Leave Encashment Provision" on the Balance Sheet.

Actuarial Gains and Losses:

- Any gains or losses arising from changes in assumptions or actual experience differing from expected are recognized in Other Comprehensive Income (OCI).

- This prevents the volatility of the actuarial valuation from directly impacting the net profit or loss for the period.

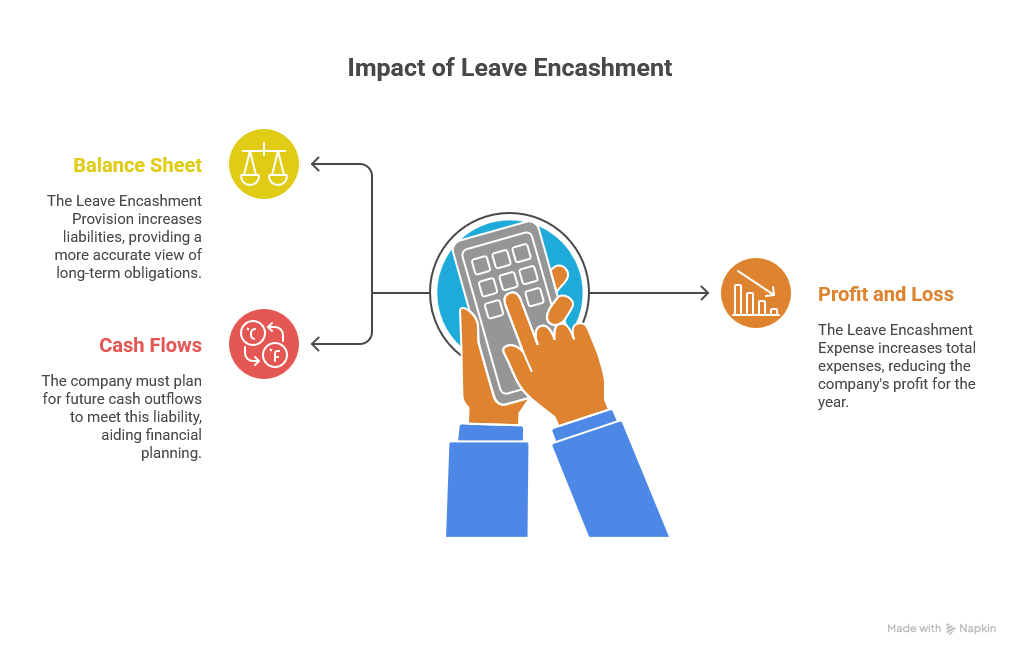

Impact on Financial Reports

- Balance Sheet: The company's financial position is impacted as the Leave Encashment Provision increases its liabilities. This provides a more accurate view of the company's long-term obligations.

- Statement of Profit or Loss: The Leave Encashment Expense increases the total expenses, which in turn reduces the company's profit for the year.

- Statement of Cash Flows: Although the expense is non-cash, the company must plan for future cash outflows to meet this liability. This helps in better financial planning and risk management.

Example Case: A company has a leave encashment policy where employees can encash a maximum of 30 days of unused leave at the time of retirement, at their last drawn salary. For the year-end report, an actuary performs a valuation.

- Employee Data: A sample employee has 25 days of accumulated leave, a current monthly salary of $5,000, and is expected to retire in 10 years.

- Assumptions: The actuary assumes a salary growth rate of 5% and a discount rate of 7%.

- Calculation: The actuary calculates the present value of the future payment of 25 days of leave, considering the expected salary at retirement and the probability of the employee staying with the company.

- Result: The valuation shows a new liability of $2,000 for this employee for the current year.

- Accounting Entry:

- Debit: Leave Encashment Expense - $2,000

- Credit: Leave Encashment Provision - $2,000

This entry recognizes the cost of the leave benefit earned by the employee during the year, ensuring the financial statements comply with the accounting standards.