Deferred Tax refers to the tax effect of temporary differences between the accounting income reported in financial statements and taxable income as per tax laws. These differences arise due to timing differences in recognizing revenue or expenses under accounting standards and tax regulations.

Deferred Tax refers to the tax effect of temporary differences between the accounting income reported in financial statements and taxable income as per tax laws. These differences arise due to timing differences in recognizing revenue or expenses under accounting standards and tax regulations.

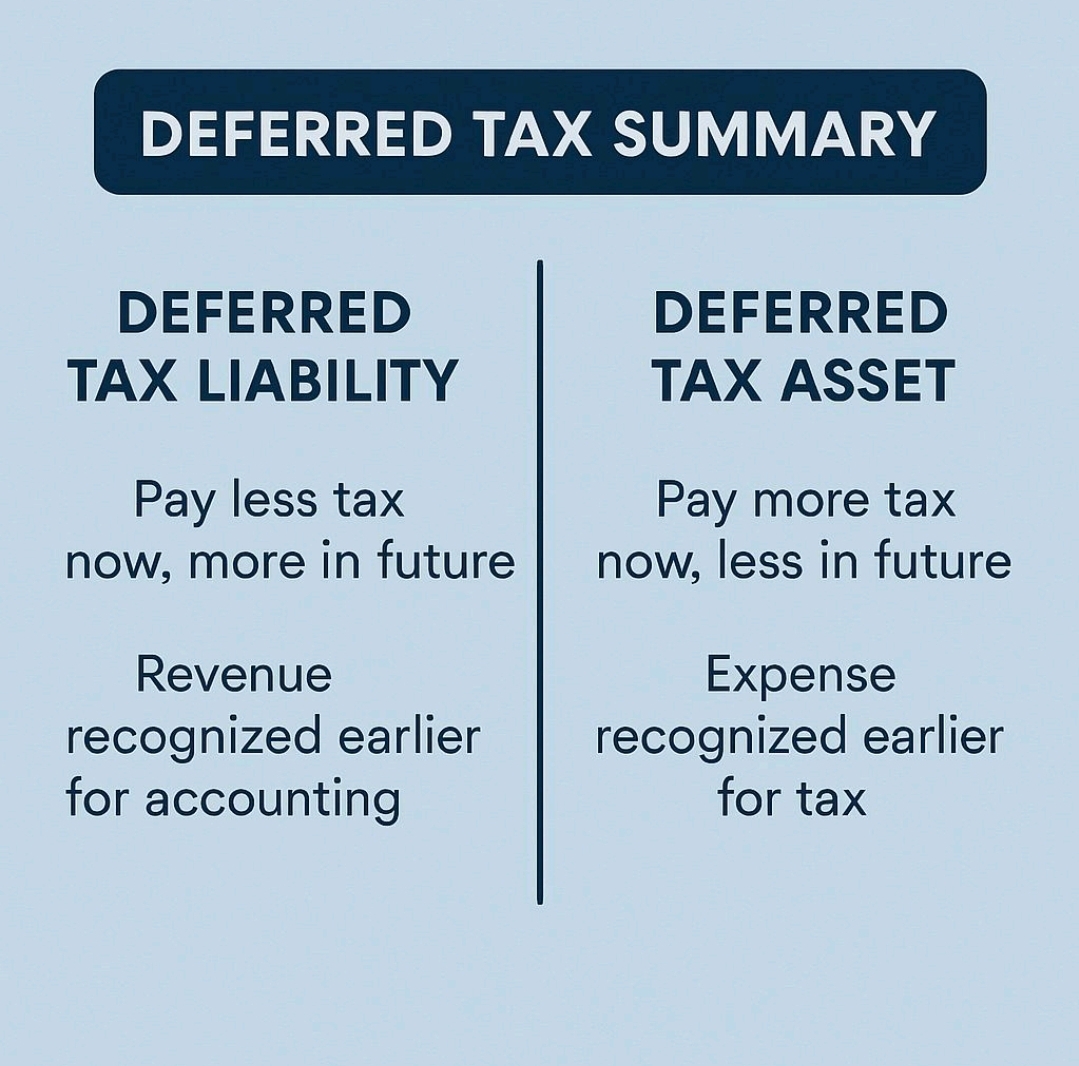

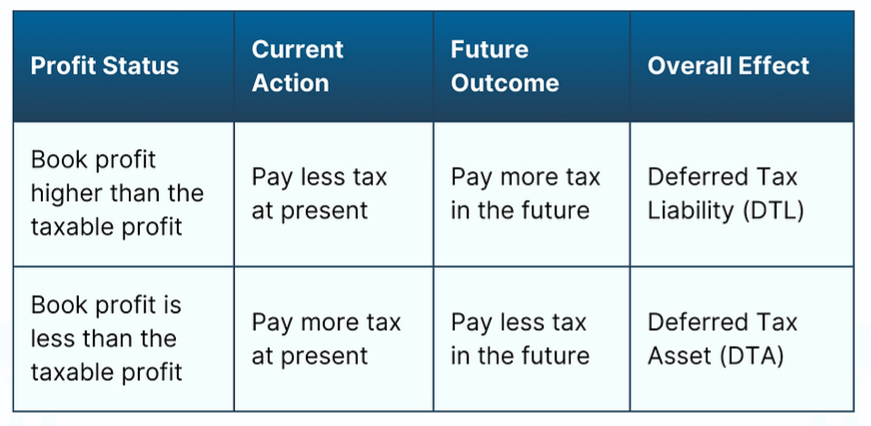

1. Deferred Tax Liability:

Definition: It represents the tax amount a company expects to pay in the future due to temporary differences between the book value of assets or liabilities and their tax base.

Reason: Deferred tax liability arises when the income tax payable in the future is higher than the current tax, due to temporary differences like:

Accelerated depreciation in tax laws versus slower depreciation in accounting.

Revenue recognized for tax purposes before it is recognized in financial statements.

Example: Suppose a company uses accelerated depreciation for tax purposes, reducing its taxable income in the current year. However, in its financial statements, it uses straight-line depreciation. This creates a difference that results in a deferred tax liability.

2. Deferred Tax Asset:

Definition: It represents the tax amount a company expects to recover in the future due to temporary differences.

Reason: Deferred tax asset arises when the income tax payable in the future is lower than the current tax, due to:

Provisions made in financial statements but not yet deducted for tax purposes.

Loss carryforwards where the company can use prior losses to offset future taxable income.

Example: Suppose a company has made provisions for doubtful debts in its financial statements, but tax rules do not allow these deductions immediately. This creates a deferred tax asset, as it will reduce taxable income in the future.

Key Concepts:

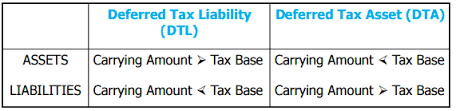

Temporary Differences: Differences between the tax base and book value of assets or liabilities, leading to deferred tax assets or liabilities. These differences reverse over time, causing taxable income to differ from accounting income.

Permanent Differences: These do not create deferred tax as they arise due to expenses or income items that are either not taxable or not deductible at any time, like fines or penalties.

Recognition: Deferred taxes are recognized to reflect future tax impacts and are essential for accurate financial reporting under accounting standards such as IAS 12 or ASC 740.

Example for Understanding:

Deferred Tax Liability: A company buys a machine for NPR 10,000, which has a useful life of 5 years. For tax purposes, the entire cost is deducted in year 1 (accelerated depreciation), but in the financial books, the company uses straight-line depreciation (NPR 2,000/year). This leads to a lower taxable income in year 1 and results in a deferred tax liability, as this temporary difference will reverse in future years.

Deferred Tax Asset: A company recognizes a warranty expense of NPR 5,000 in its financial statements, but tax laws allow the deduction only when the warranty is actually claimed. The tax base of this liability is zero, leading to a deferred tax asset for the current period.

In summary, deferred tax reflects future tax consequences due to timing differences, helping provide a clear financial position to stakeholders.