1. What is CSR? — Clear meaning

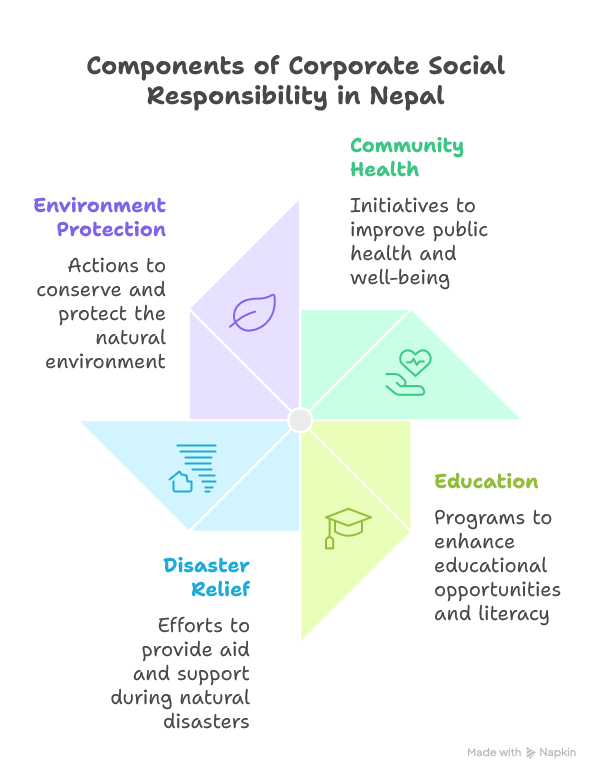

Corporate Social Responsibility (CSR) means the voluntary and/or legally-required actions that companies and industries take — beyond their core business and legal obligations — to promote social welfare, environmental sustainability and community development. In Nepal CSR covers activities such as community health, education, disaster relief and environment protection that create public benefit and reduce negative social/environmental impacts of industry.

2. Objectives of CSR (concise)

- Improve social welfare and community well-being.

- Mitigate negative environmental and social impacts of business.

- Promote inclusive development and reduce poverty and regional disparity.

- Strengthen company–community relations and corporate reputation.

- Support national priorities (disaster resilience, health, education, SDGs).

3. Importance of CSR for Nepal

- Nepal is disaster-prone and has large development gaps — CSR can fill urgent infrastructure, health and education needs in local areas.

- CSR channels private resources into development and emergency response (e.g., oxygen plants, health camps).

- Encourages sustainable business practices, social license to operate and improved investor/stakeholder confidence.

- Promotes local employment, skills and community resilience.

4. Legal & regulatory framework — overview

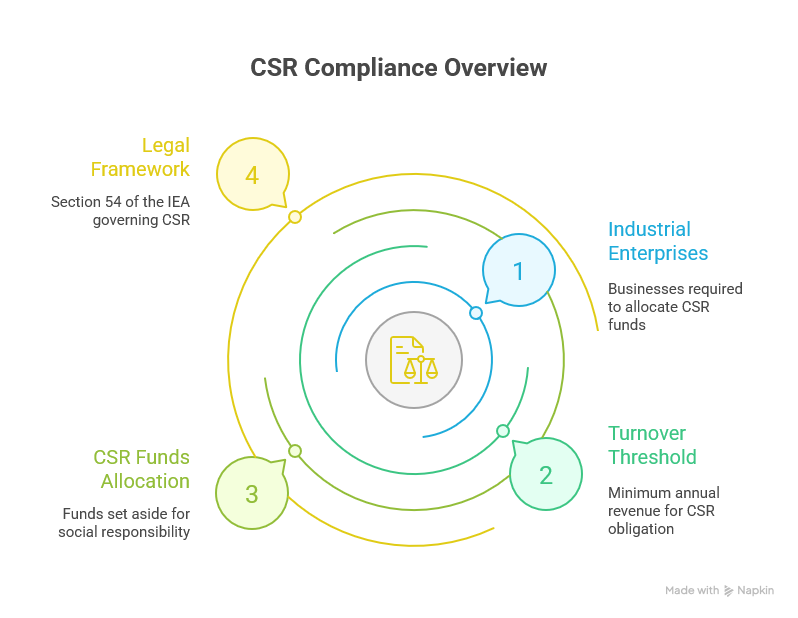

Nepal’s CSR rules are fragmented across several laws/regulators rather than a single unified CSR Act. The main regulatory points are:

Industrial Enterprises Act (IEA), 2076 (2020) — Section 54 and related rules set mandatory CSR obligations for industrial enterprises of specified size (turnover threshold), prescribe minimum set-aside, eligible sectors, geographic use and penalties for non-compliance. (Nepal Laws)

Nepal Rastra Bank (NRB) — issues CSR guidelines/circulars for Banks & Financial Institutions (BFIs) (e.g., circulars/guidelines in recent years: CSR Guidelines 2081/2082 and circulars such as 10/81/82). NRB requires BFIs to create CSR funds (minimum contribution), restricts uses, prescribes spending timelines and geographic allocation, and requires disclosure/reporting. (T.R. Upadhya & Co.)

Securities Board of Nepal (SEBON) — through corporate governance directions and circulars, SEBON has advised listed entities/market intermediaries on CSR-related practices and some allocation/disclosure expectations (particularly for market participants). (sharesansar.com)

Companies Act, 2063 (2006) — does not impose a blanket CSR spending obligation for all companies like the IEA; it focuses on company governance and disclosure obligations. Where statutory CSR obligations exist (e.g., under IEA or NRB rules), companies must comply in addition to Companies Act reporting/disclosure duties. (The iGuides)

(Note: Nepal’s Supreme Court has directed the government to prepare unified CSR legislation — highlighting the current fragmented regime.) (Farsight)

5. Who is covered / applicability (who must do CSR)

- Industrial enterprises (medium & large, and cottage/small units above a turnover threshold) with annual turnover more than NPR 150,000,000 (NPR 150 million / 15 crore) are required to set aside funds for CSR under Section 54 of the IEA. (Nepal Laws)

- Banks & Financial Institutions (BFIs) — NRB requires BFIs to create CSR funds and follow NRB’s CSR guidelines (usually a minimum 1% of net profit, specified spending heads and reporting). (Nepal Central Bank)

- Listed companies, brokers and capital market participants may also be subject to SEBON guidance and stock-market disclosure expectations. (sharesansar.com)

6. Core quantitative obligations (how much to set aside / timing)

- Minimum set-aside: IEA / Rules require covered industries to set aside at least 1% of yearly net profit for CSR (industries exceeding the turnover threshold). NRB similarly requires BFIs to set aside 1% of net profit for CSR funds under its guidelines. (Nepal Laws)

- Spending timing & carry-forward: NRB’s updated guidelines require BFIs to spend a high proportion of CSR funds within the fiscal year (press reports indicate ~60% must be spent in the year after accounts are approved, remainder can be carried forward under rules) and specify provincial distribution obligations. (Check the latest NRB circular for precise year-specific percentages.) (Tech News Nepal |)

7. Eligible CSR activities and priority areas (IEA rules & NRB lists)

Commonly authorised / priority areas under IEA rules and NRB guidelines include (non-exhaustive):

- Disaster prevention, preparedness, rescue and reconstruction (very important in Nepal). (T.R. Upadhya & Co.)

- Community health (health camps, oxygen plants, medical equipment, awareness). (sharesansar.com)

- Education, vocational training, scholarships and school infrastructure. (NepJol)

- Environment protection and climate resilience (tree planting, watershed, clean energy projects). (Ncell)

- Protection of arts, culture and heritage restoration. (T.R. Upadhya & Co.)

- Basic community infrastructure (water supply, toilets, community buildings, playgrounds). (T.R. Upadhya & Co.)

- Social inclusion & livelihood programs (support to marginalized groups, financial literacy). (Nepal Central Bank)

NRB-specific restrictions (for BFIs): CSR funds must not be used for business promotion, political gains, or to benefit related parties/board members individually; there are rules to diversify geographic allocation (e.g., minimum allocation to provinces). (Nepal Central Bank)

8. Practical rules about use / geography / deposit options

- Local benefit requirement: At least a significant portion (often 25%) of the CSR amount should be spent in areas affected by the industry (per Industrial Enterprise Rules). Up to a limited percentage (e.g., 10%) may be deposited to a government-recommended fund. These specifics are in the Industrial Enterprise Rules; companies must follow the exact percentages in the Rules. (T.R. Upadhya & Co.)

9. CSR compliance, reporting & monitoring — step-by-step

A. Policy & planning (internal):

- Board adopts a CSR policy / strategy aligned to legal requirements and company values.

- Set annual CSR budget = at least 1% of net profit (if covered). Specify heads and geographic allocation.

- Form a CSR committee (best practice) to approve projects and budgets.

B. Implementation process:

- Prioritise projects based on community needs assessment and alignment with allowed heads (disaster relief, health, education, environment).

- Select implementing partners (NGOs, local governments, contractors) with due diligence.

- Ensure procurement, conflict-of-interest checks and documentation.

- Implement with clear KPIs, beneficiary lists and timelines.

C. Accounting, internal controls & audit:

- Maintain separate accounting for CSR fund (a CSR fund account / ledger).

- Keep receipts, MOUs, beneficiary records and photos.

- Include CSR spend line items in audited financial statements / notes as required by regulators.

- Internal audit / external audit to verify CSR spending and compliance.

D. Reporting & public disclosure:

- Annual report disclosure — companies/industries should disclose CSR policy, amount set aside and actual spend, project descriptions and outcomes in annual reports (IEA, NRB and SEBON require or expect disclosure). (Company Registration in Nepal)

- Regulator filings — industries may need to submit annual CSR plans and progress reports to the industry registration body / Ministry (per IEA rules) and BFIs must file CSR reports to NRB as per NRB circulars. (Nepal Laws)

E. Monitoring & evaluation:

- Adopt basic M&E: baseline data, midline checks, final evaluation, beneficiary feedback surveys.

- Keep geo-tagged evidence and financial reconciliations.

- Use third-party verification for high-value projects (recommended, and sometimes required by NRB/SEBON).

10. Penalties, fines and legal consequences for non-compliance

Industrial Enterprises Act (Section 54) and associated Rules set out sanctions for non-compliance:

Monetary fines: If an industry fails to perform CSR under Section 54, the Ministry — on recommendation of the industry registration body — may impose a fine equal to 1.5% of the industry’s yearly net profit for the first year of non-performance. An additional fine of 0.5% of yearly net profit is chargeable for each successive fiscal year of non-compliance. Authorities can also impose smaller scale fines per type/size of enterprise for other breaches. (Nepal Water & Energy Development Company)

Withholding of incentives: The Ministry may withhold or recover incentives, exemptions, facilities or concessions granted to the industry if the enterprise contravenes relevant provisions. (Nepal Water & Energy Development Company)

Regulatory enforcement for BFIs/listed firms: NRB and SEBON can enforce guideline breaches by BFIs and market institutions through administrative actions, supervisory directions and disclosure penalties (and may restrict use of CSR funds if rules are not followed). (Nepal Central Bank)

Reputational & commercial consequences: Non-compliance can result in reputational damage, loss of social license, shareholder criticism, and potentially investor/legal scrutiny.

11. Examples from Nepal (real company practices & impact)

Ncell Axiata (telecom)

- Longstanding CSR programs in education, health and environment; multi-province projects and emergency response (e.g., COVID-19 initiatives, telemedicine collaboration). Ncell reports large cumulative CSR spending (multi-hundred million NPR) and programs across provinces. Social impact: improved access to health info, school support, public spaces. (Ncell)

Nabil Bank

- Regular CSR activities: health camps (e.g., Raute community health camp), oxygen plant donations, education and livelihood projects. These interventions provide direct health and basic infrastructure benefits in underserved areas. (nabilbank.com)

Himalayan Bank

- Donated to education initiatives, cultural restoration and social welfare projects (orphanage support, civil society collaborations). Demonstrates typical bank CSR focusing on education, cultural preservation and community welfare. (himalayanbank.com)

Impact examples (summary):

- Health infrastructure (oxygen plants, health camps): rapid life-saving support during health crises and improved local health access. (sharesansar.com)

- Education & scholarships: longer-term human capital improvement and increased school retention. (NepJol)

- Disaster resilience: rebuilding and preparedness reduce recovery times after earthquakes/floods. (T.R. Upadhya & Co.)

12. Good practice checklist for companies (ready to use)

- Board-approved CSR policy + annual CSR plan.

- Allocate at least 1% of net profit (where covered).

- Maintain separate CSR accounts & proper vouchers/MOUs.

- Spend minimum required share in host/affected communities.

- Avoid using CSR for promotion, political or related-party gains.

- Get projects third-party verified for high-value spending.

- Publish CSR disclosures in annual report and regulatory filings.

- Monitor, measure and report outputs & outcomes (beneficiaries, locations, photos, sign-offs).

13. Practical concerns & tips for Nepali companies

- Align CSR to national priorities (SDGs, disaster resilience, provincial development) — this makes CSR more acceptable to regulators and communities. (T.R. Upadhya & Co.)

- Document everything — regulators (NRB/Ministry/Industry Registration Body) require evidence; lack of proof can lead to fines. (Nepal Central Bank)

- Partner with credible local NGOs / municipalities for community reach and accountability.

- Use provincial allocation rules (for BFIs) to ensure fair geographic spread.

14. Recent regulatory developments & trend (short)

- Regulators (NRB, SEBON) have been tightening CSR rules for BFIs and capital market participants (more prescriptive spending, timelines and geo-allocation). Supreme Court has asked the government to draft a unified CSR law — indicating potential future consolidation of rules. Companies should therefore monitor regulator circulars for updates. (The Annapurna Express)

15. Where to read the primary documents (recommended reading / sources)

- Industrial Enterprises Act, 2076 — Section 54 (CSR provisions) (official texts and annotated copies). (Nepal Laws)

- Industrial Enterprise Rules (supporting rules on CSR use and percentages). (T.R. Upadhya & Co.)

- Nepal Rastra Bank CSR Guidelines / circulars for BFIs (circular no. references such as 10/81/82 and CSR Guidelines 2081/2082). (T.R. Upadhya & Co.)

- SEBON corporate governance circulars and guidance for listed entities. (Securities Board of Nepal)

16. Final recommendations (practical next steps for a company)

- Check applicability: Confirm if your company is covered by IEA (turnover threshold) or NRB/SEBON rules. (If covered, legal obligations apply; don’t rely on voluntary practice alone.) (Nepal Laws)

- Adopt/align policy: Adopt a CSR policy compliant with the IEA / NRB / SEBON rules and board approval.

- Budget & implement: Set aside 1% of net profit (if applicable), prepare annual plan and implement with robust M&E.

- Report & disclose: Include CSR details in audited annual financial statements and file whatever regulator returns are required. (Company Registration in Nepal)

- Document to avoid penalties: Keep complete records to demonstrate compliance and local benefit — this prevents fines and withholding of incentives.

If you want, I can:

- Produce a short CSR policy template tailored to an Nepali industrial enterprise or bank (board-ready).

- Produce a 1-page CSR implementation checklist and reporting template (financial lines, activity tracker, proof checklist).

Which one should I prepare for you now?