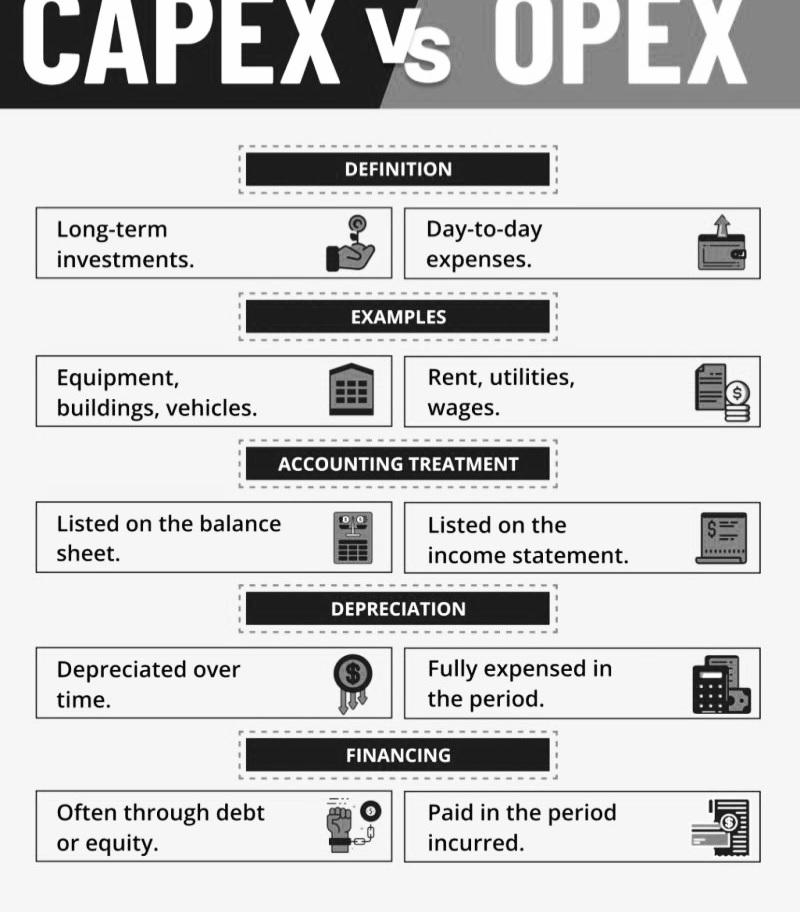

Capital Expenditure (Capex) involves long-term investments to acquire or upgrade assets, recorded on the balance sheet and depreciated over time, while Revenue Expenditure (Revex) includes short-term operating costs for daily activities, expensed fully in the income statement within the financial year.

Here's a clear comparison between Capital Expenditure (Capex) and Revenue Expenditure (Revex):

- Definition:

Capex: Expenses incurred to acquire or upgrade physical assets like property, equipment, or technology, adding value over the long term.

Revex: Day-to-day operational expenses required to maintain an asset or ensure the normal functioning of a business.

- Purpose:

Capex: Incurred to create future benefits or enhance long-term productivity and efficiency.

Revex: Incurred to sustain daily business operations and generate revenue within the same financial year.

- Duration:

Capex: Has a long-term impact, usually benefitting the business over multiple years.

Revex: Has a short-term impact, typically covering costs within the current accounting year.

- Asset Creation:

Capex: Leads to the creation or enhancement of an asset, which is capitalized in the balance sheet.

Revex: Does not result in the creation of assets and is expensed in the income statement.

- Depreciation/Amortization:

Capex: Depreciated (for tangible assets) or amortized (for intangible assets) over the useful life of the asset.

Revex: Fully deducted in the profit and loss account in the period they occur.

- Impact on Financial Statements:

Capex: Recorded as an asset on the balance sheet and then expensed gradually.

Revex: Recorded directly as an expense on the income statement, reducing net profit.

- Examples:

Capex: Purchase of machinery, construction of buildings, acquisition of patents, or software development costs.

Revex: Salaries, rent, utility bills, repair costs, and routine maintenance expenses.

- Funding:

Capex: Often funded through long-term financing, like loans, bonds, or retained earnings.

Revex: Typically covered through operating revenue or working capital.

- Tax Treatment:

Capex: Not fully tax-deductible in the year it is incurred; only depreciation can be claimed for tax deductions.

Revex: Generally fully tax-deductible in the financial year it is incurred.

- Decision Making:

Capex: Requires extensive planning and approval from higher management or the board due to its impact on long-term financial strategy.

Revex: Usually requires less extensive approval and is more routine in nature.

This differentiation is crucial for managing financial resources efficiently and planning for future growth and sustainability.