A Cash Flow Statement is a financial report that provides a summary of a company's cash inflows and outflows over a specific period, categorized into operating, investing, and financing activities. It shows how cash is generated and used, helping stakeholders assess the company’s liquidity, financial health, and ability to meet obligations or invest in growth.

The Cash Flow Statement is divided into three main sections:

Operating Activities: Cash flows related to the core business operations, including cash received from customers and cash paid for expenses, salaries, and taxes.

Investing Activities: Cash flows from the purchase or sale of assets, like property, equipment, or investments.

Financing Activities: Cash flows from transactions with lenders and shareholders, such as issuing shares, borrowing, or repaying loans and paying dividends.

These sections collectively reflect the overall movement of cash within a company.

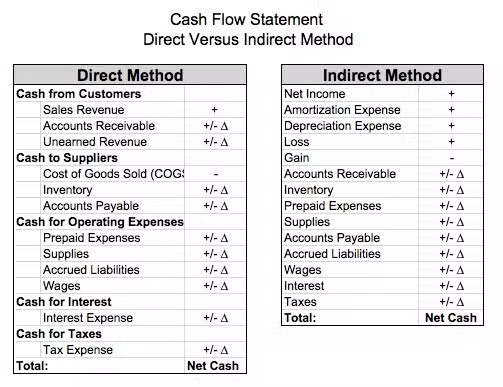

Here are the key differences between the Direct and Indirect Cash Flow Statements:

- Method of Presentation:

Direct Method: Lists actual cash receipts and payments from operating activities.

Indirect Method: Starts with net income and adjusts for non-cash items and changes in working capital.

- Starting Point:

Direct Method: Begins with cash inflows and outflows from operations, like cash received from customers and cash paid to suppliers.

Indirect Method: Begins with net profit or loss and adjusts for items that affected income but not cash.

- Details Provided:

Direct Method: Provides detailed information about specific sources and uses of cash.

Indirect Method: Provides a summary that links net income to operating cash flows.

- Ease of Use:

Direct Method: More complex to prepare, requiring detailed cash transaction data.

Indirect Method: Easier to prepare since it uses information readily available from the income statement and balance sheet.

- Preferred by Standard-Setters:

Direct Method: Preferred by accounting standards like IFRS and GAAP, as it offers clearer insight into cash flows.

Indirect Method: More commonly used in practice despite being less preferred, due to ease of preparation.

- Adjustment Requirements:

Direct Method: Does not require adjustments for non-cash items, as it reports actual cash flows.

Indirect Method: Requires adjustments for depreciation, amortization, and changes in working capital.

- User Insights:

Direct Method: Provides a clearer understanding of where cash is coming from and going.

Indirect Method: Helps users understand the relationship between net income and operating cash flows.

- Impact on Financial Analysis:

Direct Method: Useful for analyzing cash flow efficiency and liquidity management.

Indirect Method: Useful for assessing the quality of earnings and the impact of non-cash expenses.

- Company Preference:

Direct Method: Often used by companies seeking to provide more detailed cash flow information.

Indirect Method: Preferred by companies with more complex accounting structures.

- Regulatory Reporting:

Direct Method: Some regulatory frameworks encourage its use but do not require it.

Indirect Method: Widely accepted and compliant with most reporting standards without additional requirements.

Both methods ultimately reconcile to the same net cash flow from operating activities but differ in the presentation and preparation approach.