IFRS 16, which came into effect on January 1, 2019, establishes the principles for the recognition, measurement, presentation, and disclosure of leases in financial statements. It replaced IAS 17 and introduced significant changes, especially in how lessees account for leases. Under IFRS 16, lessees must recognize nearly all lease arrangements on the balance sheet, including both a right-of-use (ROU) asset and a corresponding lease liability. This approach eliminates the previous distinction between operating and finance leases for lessees, making lease obligations more transparent.

Under IFRS 16, lessees must recognize a right-of-use asset and a lease liability at the commencement of a lease, with subsequent entries reflecting interest expense and depreciation, while reporting requirements mandate clear presentation on the balance sheet, income statement, and cash flow statement, enhancing transparency around leasing activities.

Key Points:

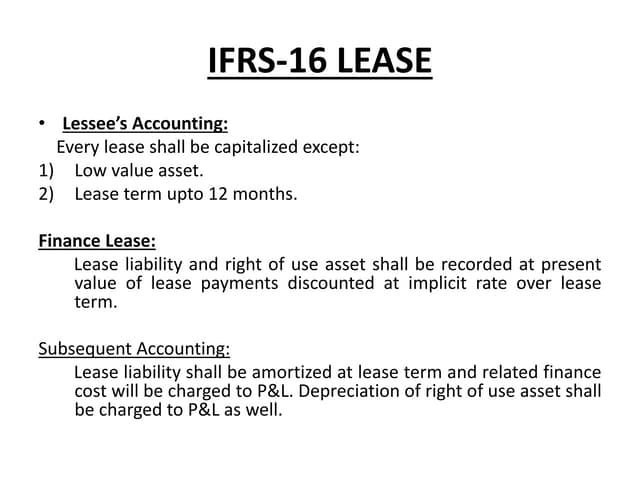

Lessee Accounting: Lessees record a right-of-use asset and a lease liability, which is initially measured at the present value of lease payments. This change affects key financial metrics, such as debt ratios and EBITDA, as operating leases are no longer expensed on a straight-line basis.

Lessor Accounting: For lessors, the accounting model remains largely unchanged from IAS 17, continuing to classify leases as either operating or finance leases.

Impact on Financial Reporting: The standard aims to improve the comparability of financial statements and provide a clearer picture of a company’s leasing activities. However, it has implications for financial ratios, asset turnover, and profit metrics, influencing decision-making and contract negotiations.

Exemptions: Short-term leases (less than 12 months) and leases of low-value assets (such as laptops or office furniture) can be exempted from balance sheet recognition.

The adoption of IFRS 16 requires careful consideration of its impact on financial statements, lease agreements, and corporate strategies.

Accounting Entries and Reporting Under IFRS 16

- Initial Recognition and Measurement (Lessee Accounting)

Upon commencement of the lease, the lessee recognizes a right-of-use (ROU) asset and a lease liability.

Initial Journal Entry:

Debit: Right-of-Use Asset

Credit: Lease Liability

The lease liability is measured at the present value of future lease payments, using the interest rate implicit in the lease or the lessee’s incremental borrowing rate if the implicit rate is not readily determinable. The ROU asset includes the lease liability amount, initial direct costs, and any lease payments made at or before the commencement date.

- Subsequent Measurement

Lease Liability: The lease liability is subsequently measured at amortized cost, with periodic interest expense recognized.

Debit: Interest Expense

Credit: Lease Liability

Right-of-Use Asset: The ROU asset is depreciated over the shorter of its useful life or the lease term.

Debit: Depreciation Expense

Credit: Accumulated Depreciation – Right-of-Use Asset

- Exemptions and Simplifications

For short-term leases and low-value asset leases, the lessee may choose to recognize lease payments as an expense on a straight-line basis rather than recognizing an ROU asset and lease liability.

Journal Entry for Expense:

Debit: Lease Expense

Credit: Cash/Bank

![![enter image description here][4]](https://santoshtandukar.com.np/content/images/20241102232144-1000010640.jpg)

Reporting Requirements

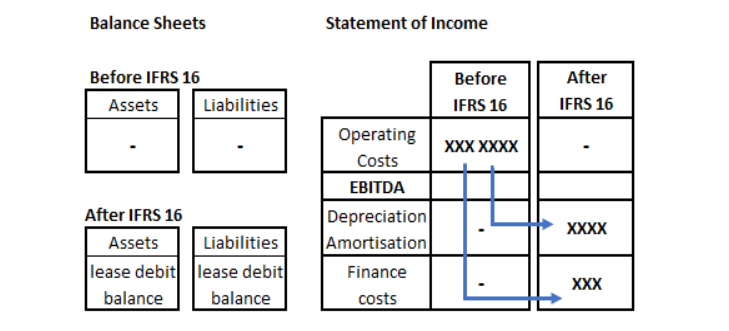

Balance Sheet: The ROU asset is presented either as a separate line item or within the same line item as the underlying asset class, while the lease liability is shown under liabilities.

Income Statement: Lease expenses are split into depreciation of the ROU asset and interest expense on the lease liability. This presentation may impact key metrics like EBITDA.

Cash Flow Statement: Lease payments are split into principal and interest portions. The principal payments are classified as financing activities, while the interest portion is presented as either operating or financing activities based on the lessee's accounting policy.

These entries and reporting standards under IFRS 16 provide more transparency in a company's financial statements, reflecting the economic impact of leases more accurately compared to the previous IAS 17 model.