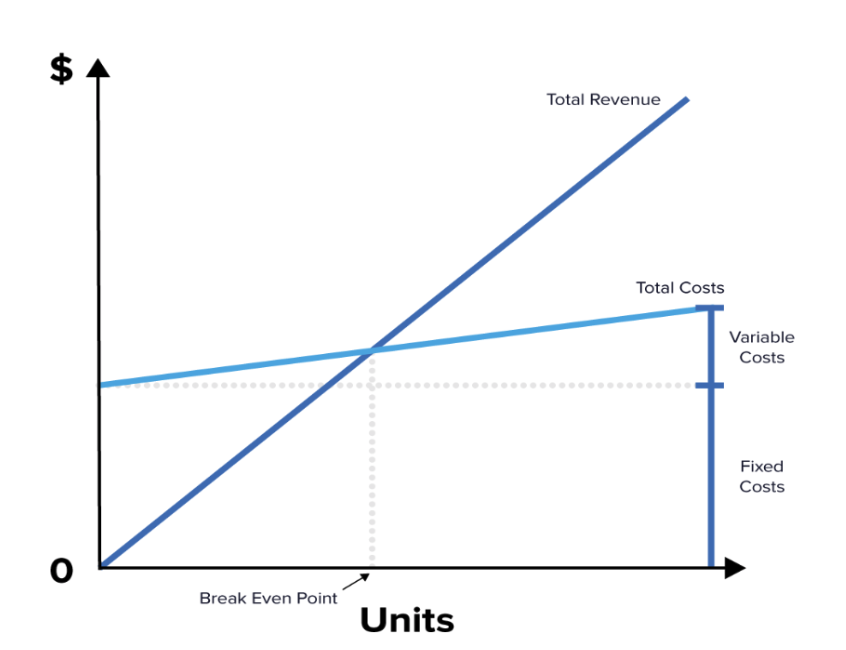

The Break Even Point (BEP) is a financial measure that shows when a company’s total revenue is equal to its total costs, meaning it is neither making a profit nor incurring a loss. Reaching the break even point indicates that a business has covered all of its expenses.

Why Break Even Point Is Important:

Profit Planning: It helps businesses determine the minimum amount of sales they need to avoid losing money and to start making a profit.

Cost Control: It highlights the importance of managing expenses effectively to reach profitability sooner.

Strategic Decision Making: BEP analysis can guide decisions on pricing, cost management, and whether to expand or reduce operations.

Risk Management: Knowing the break even point helps in evaluating how much sales can decline before the business starts losing money, thus aiding in risk assessment.

How to Calculate It:

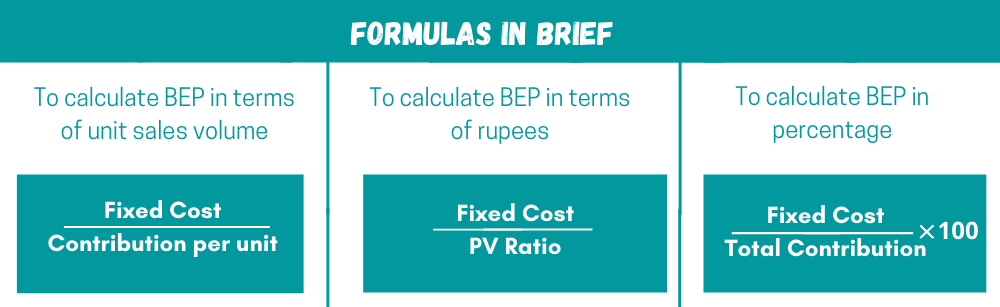

To find the BEP, you need to know your fixed costs, selling price per unit, and variable costs per unit:

Fixed Costs: These are expenses that do not change regardless of how much you produce or sell, like rent and salaries.

Selling Price per Unit: This is the price you charge for each product.

Variable Costs per Unit: These costs change with production levels, like the cost of raw materials.

To calculate the break even point, you figure out how many units need to be sold to cover all fixed and variable costs or how much total sales revenue is needed to break even. This information is crucial for understanding your business's financial health and planning effectively to ensure profitability.

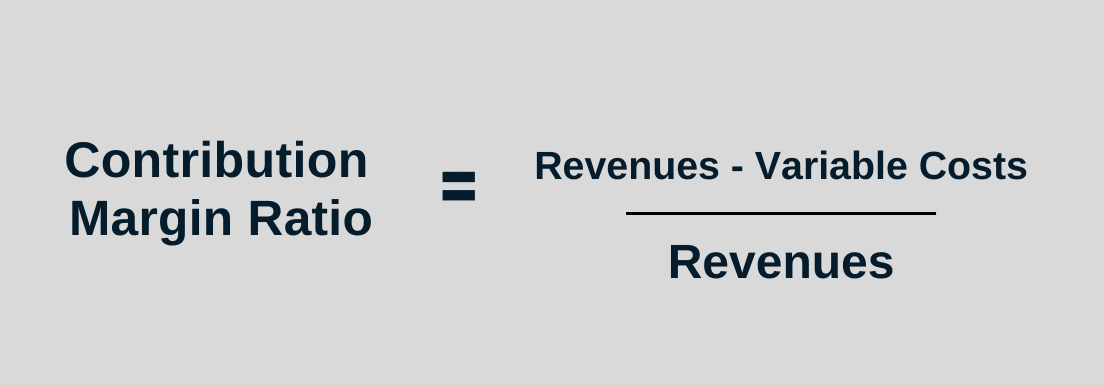

The Contribution Margin is a financial metric that shows how much revenue from sales is left over after covering the variable costs associated with producing a product or service. This remaining amount contributes to covering fixed costs and eventually helps generate profit.

Why Contribution Margin Is Important:

Profit Analysis: It helps businesses understand the profitability of individual products or services, which aids in making decisions about product lines or pricing strategies.

Cost Management: By analyzing contribution margins, companies can identify which products are more profitable and focus on improving or eliminating less profitable items.

Break Even Analysis: Contribution margin is essential for calculating the break even point, as it shows how much of each sale contributes toward covering fixed costs.

How It Works:

Contribution Margin per Unit: This measures how much profit is generated from each unit sold after accounting for variable costs.

Contribution Margin Ratio: This expresses the contribution margin as a percentage of sales revenue, showing the portion of each sales dollar available to cover fixed costs and contribute to profit.

Understanding contribution margin helps managers make informed decisions about pricing, cost control, and product strategy to maximize overall profitability.

Break-even analysis compares income from sales to the fixed costs of doing business. The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP).

When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars.