Here are the stepwise procedures for both the Authorization Flow and Capture and Settlement Flow based on the image:

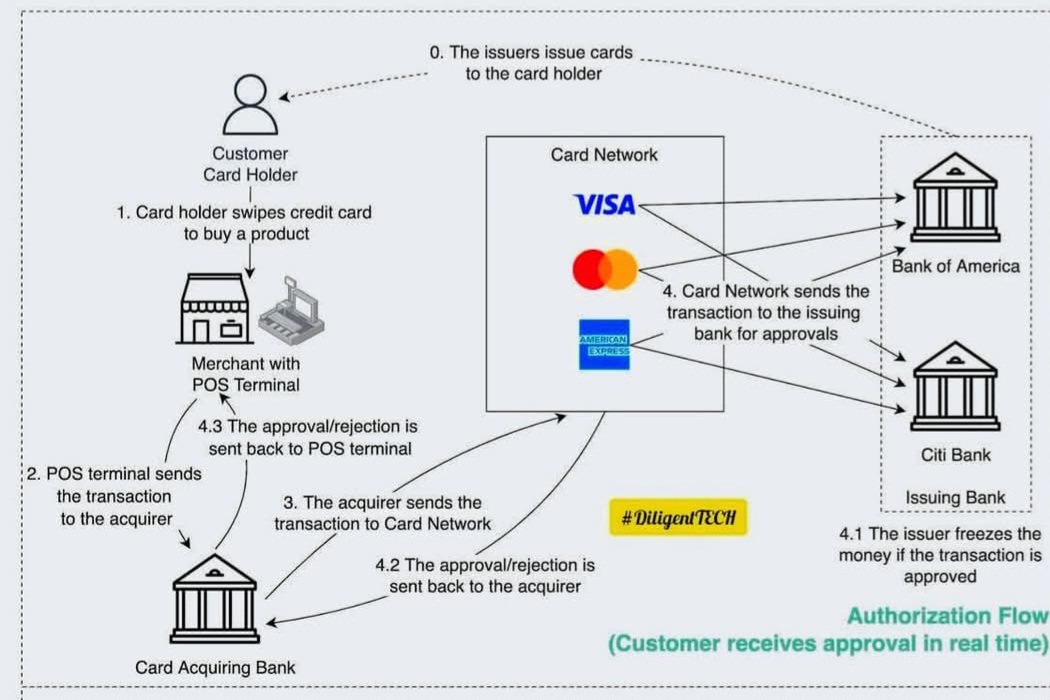

Authorization Flow (Customer receives approval in real time)

Issuers issue cards – The issuing bank provides a credit/debit card to the cardholder.

Cardholder initiates payment – The customer swipes or inserts their card at a POS terminal to make a purchase.

POS terminal forwards transaction – The POS system sends the transaction details to the acquiring bank.

Acquiring bank sends to card network – The acquirer forwards the transaction request to the card network (e.g., VISA, Mastercard).

Card network forwards to issuing bank – The transaction is sent to the respective issuing bank (e.g., Bank of America, Citi Bank) for approval.

Issuing bank approves/rejects transaction – The issuer checks the customer's account, and if sufficient funds or credit is available, it approves and freezes the amount.

Approval/rejection sent back – The response is sent back through the same chain:

Issuing bank → Card network → Acquiring bank → POS terminal.

- Customer completes transaction – If approved, the transaction is successful, and the customer gets the product or service.

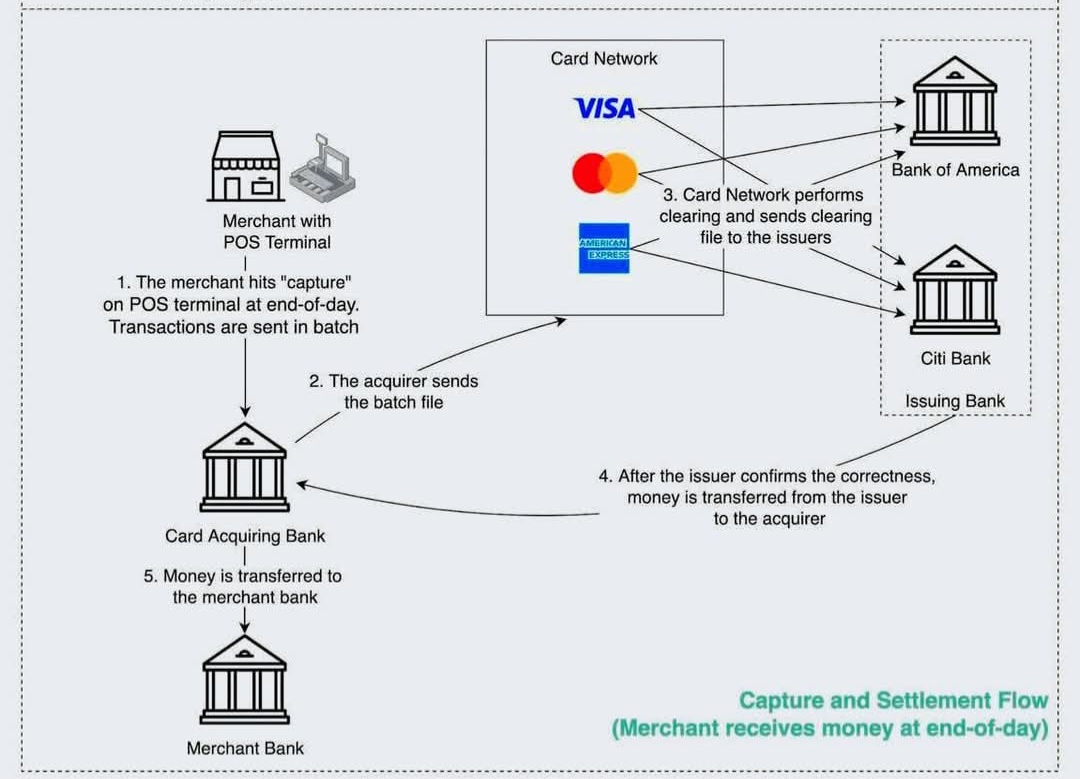

Capture and Settlement Flow (Merchant receives money at end-of-day)

Merchant captures transactions – At the end of the day, the merchant selects "capture" on the POS terminal to process all approved transactions in a batch.

Acquiring bank receives batch file – The acquirer collects the batch file from the merchant.

Card network processes clearing – The acquirer sends the batch file to the card network (e.g., VISA), which then forwards it to issuing banks for settlement.

Issuing bank transfers funds – The issuer verifies and transfers the appropriate funds to the acquiring bank.

Funds reach merchant's bank – The acquiring bank transfers the money to the merchant’s bank, completing the transaction settlement.

This process ensures that while the authorization happens in real time, actual fund transfer to the merchant occurs later, usually at the end of the day.