The Income Statement, officially referred to as the Statement of Profit or Loss and Other Comprehensive Income under International Financial Reporting Standards (IFRS), is a vital financial report that provides a detailed summary of an entity’s financial performance over a specific accounting period. It presents a clear view of revenue, expenses, profits, and other comprehensive income, allowing stakeholders to assess the profitability and overall financial health of the entity.

Objectives of the Income Statement

The Income Statement plays a pivotal role in financial reporting. Its key objectives include:

Performance Evaluation: It measures an entity’s financial performance by comparing revenues earned with expenses incurred during the period, reflecting the efficiency and effectiveness of operations.

Facilitating Decision-Making: By providing a detailed breakdown of income and expenses, it aids managers, investors, and creditors in making informed decisions about resource allocation and investments.

Comparability: Prepared in line with IFRS standards, the Income Statement ensures consistency across industries and entities, making financial performance easier to compare over time or among peers.

Predicting Future Cash Flows: Analyzing the components of income and expenses helps users estimate the entity's potential for generating future cash flows.

Regulatory Compliance: Adherence to IFRS ensures the Income Statement complies with international accounting standards, fostering trust and transparency among stakeholders.

Elements of the Income Statement under IFRS

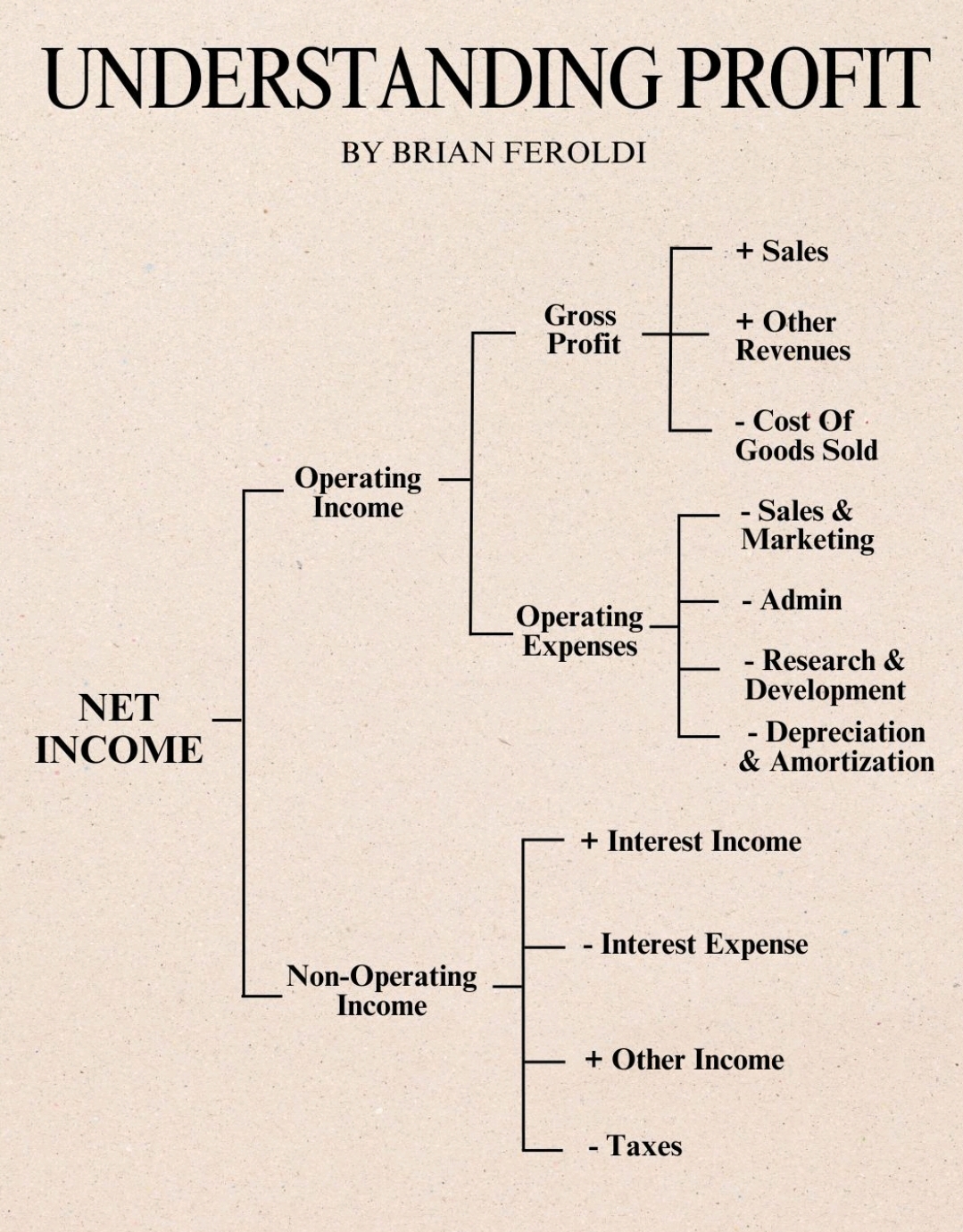

The Income Statement as per IFRS consists of several essential components:

- Revenue (Income):

Revenue represents the gross inflow of economic benefits generated from an entity's core business activities, such as the sale of goods or services. It is recognized when performance obligations are satisfied, and control is transferred to the customer.

Governed by IFRS 15 – Revenue from Contracts with Customers.

Revenue includes sales, service income, interest income, and other operational earnings.

- Expenses:

Expenses represent the outflow of economic resources incurred to generate revenue. These are classified into:

Cost of Goods Sold (COGS): Direct costs linked to producing goods or services.

Operating Expenses: General business expenses like salaries, rent, utilities, and marketing costs.

Finance Costs: Costs associated with borrowing, such as interest expenses.

- Profit or Loss:

The net result of revenues and expenses is categorized into:

Gross Profit: Revenue minus COGS.

Operating Profit: Gross profit minus operating expenses, reflecting profit from core activities.

Profit Before Tax (PBT): Operating profit adjusted for non-operating income and finance costs.

Profit After Tax (PAT): PBT minus tax expenses, representing net income attributable to shareholders.

- Other Comprehensive Income (OCI):

OCI includes items not classified in profit or loss but directly impact equity. These items highlight gains or losses arising from non-operational activities, such as:

Revaluation gains on property, plant, and equipment (IAS 16).

Foreign currency translation differences from consolidating foreign operations.

Unrealized gains or losses on certain financial instruments (IFRS 9).

Actuarial gains or losses on defined benefit plans (IAS 19).

- Total Comprehensive Income:

This represents the combined total of profit or loss and other comprehensive income for the reporting period, providing a holistic view of changes in the entity’s equity not resulting from transactions with owners.

Format of the Income Statement

IFRS allows two approaches for presenting the Income Statement:

- Single-Statement Approach:

Combines the Profit or Loss section and Other Comprehensive Income into one continuous statement.

- Two-Statement Approach:

Separates the Statement of Profit or Loss from the Statement of Other Comprehensive Income, presenting each section in a standalone format.

Regardless of the format chosen, the following elements must be included:

Revenue

Expenses (including COGS, operating, and finance costs)

Tax expense

Net profit or loss

Items of Other Comprehensive Income

Total Comprehensive Income

Key Standards Governing the Income Statement under IFRS

- IAS 1 – Presentation of Financial Statements:

Establishes the overall requirements for financial statements, including their structure and minimum content.

Allows classification of expenses either by their nature (e.g., raw materials, depreciation) or by their function (e.g., COGS, administrative expenses).

- IFRS 15 – Revenue from Contracts with Customers:

Provides principles for recognizing revenue, focusing on the satisfaction of performance obligations.

- IAS 12 – Income Taxes:

Governs the recognition and measurement of tax expenses, including current and deferred tax liabilities.

- IFRS 9 – Financial Instruments:

Specifies how to account for financial instruments, including unrealized gains or losses reported in OCI.

Example of an Income Statement (Single-Statement Format)

Statement of Profit or Loss and Other Comprehensive Income for the Year Ended December 31, 202X

| Particulars | Amount (USD) |

|---|---|

| Revenue | 1,200,000 |

| Less: Cost of Goods Sold (COGS) | (700,000) |

| Gross Profit | 500,000 |

| Operating Expenses | (300,000) |

| Operating Profit | 200,000 |

| Finance Income | 10,000 |

| Finance Costs | (20,000) |

| Profit Before Tax (PBT) | 190,000 |

| Tax Expense | (50,000) |

| Profit for the Year | 140,000 |

| Other Comprehensive Income (OCI): | |

| Gain on Revaluation of Assets | 15,000 |

| Foreign Currency Translation Differences | 5,000 |

| Total Comprehensive Income | 160,000 |

Key Insights from the Income Statement

Understanding Profitability: Provides a clear picture of an entity’s financial performance by showing the net result of revenues and expenses.

Trend Analysis: Allows users to track changes in revenue, expenses, and profits over multiple periods, offering insights into business growth.

Expense Control: Detailed categorization of expenses helps in identifying areas requiring cost management and efficiency improvements.

Risk Exposure: Items like finance costs and foreign exchange losses reveal the entity’s exposure to financial risks.

Comprehensive Reporting: Including OCI ensures transparency about non-operational gains or losses that affect equity, offering a complete view of financial performance.

Conclusion

The Income Statement under IFRS provides a structured and comprehensive view of an entity's financial performance. By adhering to standardized guidelines, it enhances transparency, comparability, and decision-making for stakeholders. Understanding its elements, structure, and objectives is essential for interpreting financial data and assessing an entity’s financial health effectively.