Statement of Shareholders' Equity

The Statement of Shareholders' Equity (also known as the Statement of Changes in Equity) is a financial statement that outlines the changes in a company's equity during a specific period. It provides insights into how the company’s net worth has evolved due to operations, investments, and financing activities.

Objectives of the Statement of Shareholders’ Equity

Track Equity Changes: Shows the movement in shareholders' equity accounts over a period.

Transparency: Provides stakeholders with a clear understanding of the factors affecting the company's equity.

Performance Evaluation: Highlights how retained earnings, dividends, and other factors contribute to equity.

Investor Confidence: Assures shareholders about the company’s financial stability and growth prospects.

Regulatory Compliance: Ensures adherence to financial reporting standards.

Elements of the Statement of Shareholders’ Equity

- Common Stock:

Represents the initial and additional funds invested by shareholders in exchange for ownership.

Includes both par value and any additional paid-in capital.

- Preferred Stock:

The equity issued to preferred shareholders with priority over common shareholders in dividends and liquidation.

- Additional Paid-In Capital (APIC):

Excess funds received from shareholders over and above the par value of stock issued.

- Retained Earnings:

Accumulated profits or losses retained in the company after paying dividends.

Formula: Retained Earnings (End) = Retained Earnings (Start) + Net Income - Dividends.

- Treasury Stock:

Shares repurchased by the company, reducing equity as these are not outstanding.

Recorded as a negative figure in equity.

- Other Comprehensive Income (OCI):

Items that bypass the income statement, such as unrealized gains/losses on investments, foreign currency translations, or pension adjustments.

- Non-Controlling Interest (if applicable):

Equity attributable to minority shareholders in subsidiaries, if the company consolidates results.

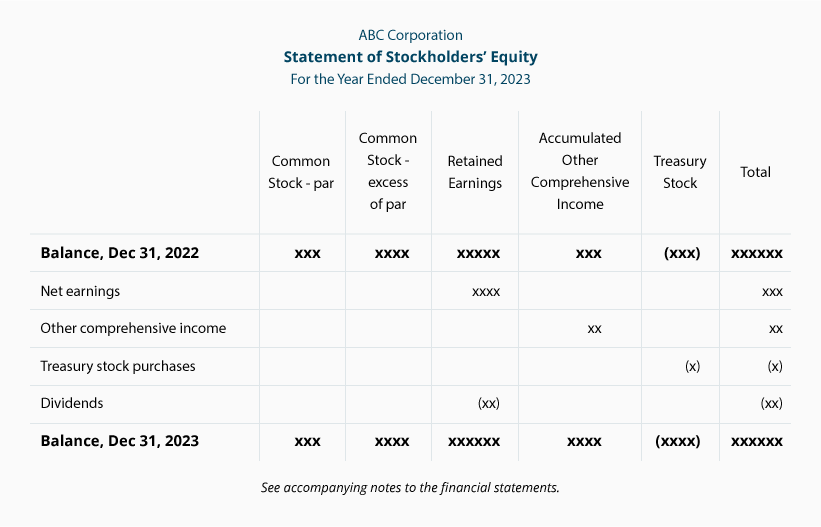

Structure of the Statement of Shareholders’ Equity

Importance and Analysis

- Investor Decision-Making:

Investors can assess profitability and dividend policies.

- Company Stability:

Highlights the company’s ability to grow and maintain positive equity.

- Capital Management:

Reflects how effectively the company utilizes and manages its equity.

- Risk Assessment:

A decline in equity over time might signal financial instability.

Conclusion

The Statement of Shareholders’ Equity is a critical component of financial reporting that provides an overview of changes in ownership and equity during a given period. By analyzing this statement, stakeholders gain a deeper understanding of the company’s financial health, investment potential, and overall performance.