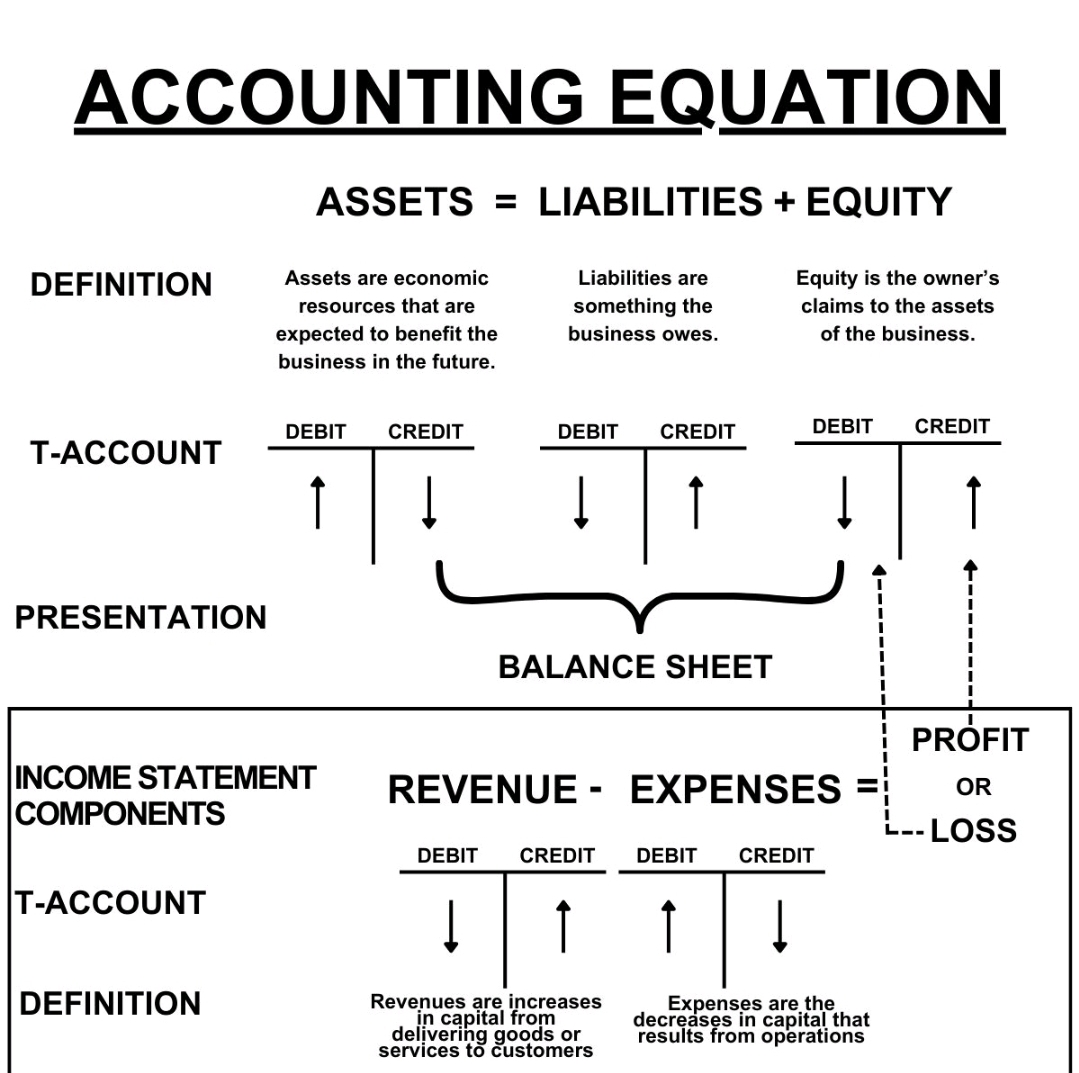

The Balance Sheet, also known as the Statement of Financial Position, is a financial statement that provides a snapshot of an entity's financial position at a specific point in time. It is structured to show the entity’s Assets, Liabilities, and Equity, following the accounting equation:

Assets = Liabilities + Equity

As per International Financial Reporting Standards (IFRS), the Balance Sheet items are categorized as follows:

- Assets

Assets are resources controlled by the entity from which future economic benefits are expected. They are classified as:

a. Current Assets

Assets expected to be converted into cash or used up within one year or the operating cycle. Examples:

Cash and Cash Equivalents

Trade Receivables

Inventories

Other Current Financial Assets (e.g., short-term investments)

Prepayments

b. Non-Current Assets

Assets held for long-term use, not intended for quick conversion into cash. Examples:

Property, Plant, and Equipment (PPE)

Intangible Assets (e.g., goodwill, patents)

Investment Property

Financial Assets (e.g., long-term investments)

Deferred Tax Assets

- Liabilities

Liabilities represent the obligations of the entity, arising from past events, that are expected to result in outflows of resources.

a. Current Liabilities

Obligations due to be settled within one year or the operating cycle. Examples:

Trade Payables

Short-Term Borrowings

Current Tax Liabilities

Accrued Expenses

Current Portion of Long-Term Debt

b. Non-Current Liabilities

Obligations that are not due within the next year. Examples:

Long-Term Borrowings

Lease Liabilities

Deferred Tax Liabilities

Provisions (e.g., pensions, warranties)

- Equity

Equity represents the residual interest in the entity’s assets after deducting liabilities. It consists of:

Share Capital (e.g., common or preferred shares)

Share Premium (amount received over the par value of shares)

Retained Earnings (accumulated profits not distributed as dividends)

Other Comprehensive Income (e.g., unrealized gains/losses on financial instruments)

Non-Controlling Interest (equity attributable to minority shareholders in subsidiaries, if any)

IFRS Requirements for the Balance Sheet

Presentation Order: IFRS does not prescribe a specific format, but items must be classified clearly into current and non-current categories.

Minimum Disclosure: IAS 1 requires certain minimum items to be presented on the face of the Balance Sheet, including total assets, total liabilities, and equity components.

Comparative Information: Entities must present at least two years of comparative figures for all items.

By following IFRS, the Balance Sheet ensures global comparability and transparency, aiding stakeholders in assessing the entity’s financial health.