What is a Cash Flow Statement?

A Cash Flow Statement (CFS) is a financial statement that provides a summary of a company’s cash inflows and outflows over a specific period. It categorizes cash movements into operating, investing, and financing activities, showing how cash is generated and used in the business. Unlike income statements, the CFS focuses solely on cash, not accounting profits.

Methods of Preparing Cash Flow Statement

- Direct Method:

Lists all major cash receipts (like cash from customers) and payments (like cash paid to suppliers).

Provides a clear view of cash inflows and outflows but requires detailed transaction records.

- Indirect Method:

Begins with net income from the income statement and adjusts for non-cash expenses (e.g., depreciation) and changes in working capital.

Commonly used due to the ease of preparation with available financial data.

Elements of Cash Flow Statement

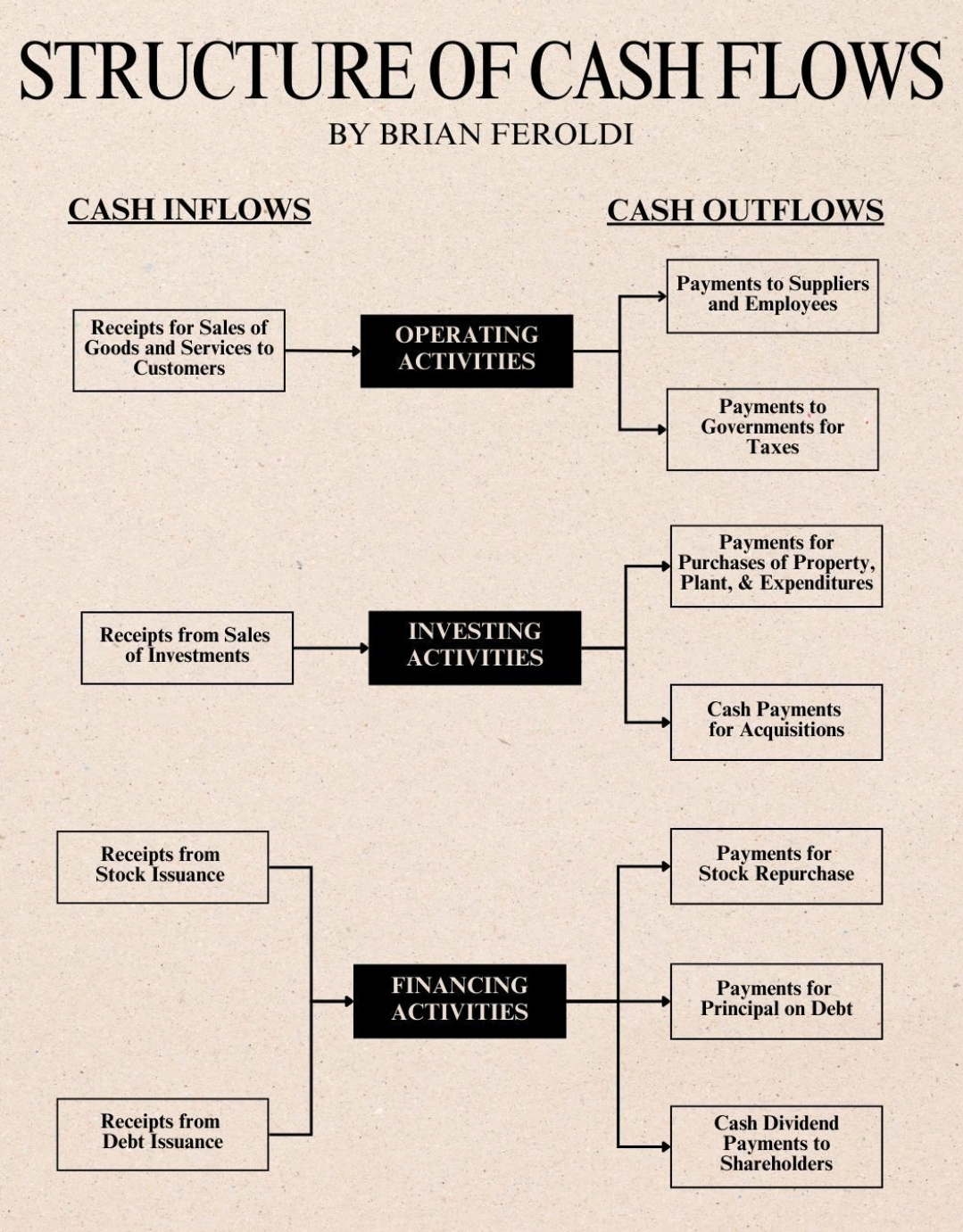

- Operating Activities:

Cash flows from core business operations.

Examples:

Cash receipts from customers

Cash payments for goods and services

Adjustments for non-cash items (depreciation, gains/losses)

Changes in working capital (inventory, receivables, payables)

Analysis: Positive operating cash flow indicates a healthy core business; negative indicates operational inefficiency.

- Investing Activities:

Cash flows from acquisition and disposal of long-term assets.

Examples:

Purchase/sale of property, plant, and equipment

Purchase/sale of investments

Lending or collecting loans

Analysis: A negative cash flow here is normal for growing businesses investing in assets; excessive outflows might signal over-investment.

- Financing Activities:

Cash flows related to raising or repaying capital.

Examples:

Issuance/repurchase of shares

Borrowing or repaying loans

Payment of dividends

Analysis: Positive financing cash flow indicates fund-raising, while negative indicates repayment or distribution of dividends.

Analysis of Cash Flow Statement

- Liquidity Assessment:

Helps assess whether the company can meet short-term obligations.

- Financial Health:

Shows the sustainability of operating activities as a source of cash.

- Investment Insight:

Indicates how much the company is investing in growth and expansion.

- Capital Structure:

Reveals the dependency on external financing versus internal cash generation.

- Decision-Making:

Useful for stakeholders to evaluate cash management efficiency, identify trends, and make informed decisions.

Conclusion

The Cash Flow Statement is a vital tool for understanding a company’s financial dynamics. It complements the income statement and balance sheet, offering insights into liquidity, solvency, and financial flexibility. A well-analyzed CFS aids in evaluating operational efficiency, investment strategies, and financing policies, enabling better decision-making.