Discounted Cash Flow (DCF) is a financial valuation method used to estimate the value of an investment based on its future cash flows. It calculates the present value of expected future cash flows using a discount rate, reflecting the time value of money. The idea is that a dollar today is worth more than a dollar in the future due to its earning potential.

Example:

Imagine you are considering investing in a project expected to generate $10,000 per year for the next 5 years. If the discount rate (reflecting the risk and opportunity cost of investing) is 8%, the DCF formula is used to calculate the present value of these cash flows. Using DCF, you can determine how much the future cash flows are worth in today’s terms.

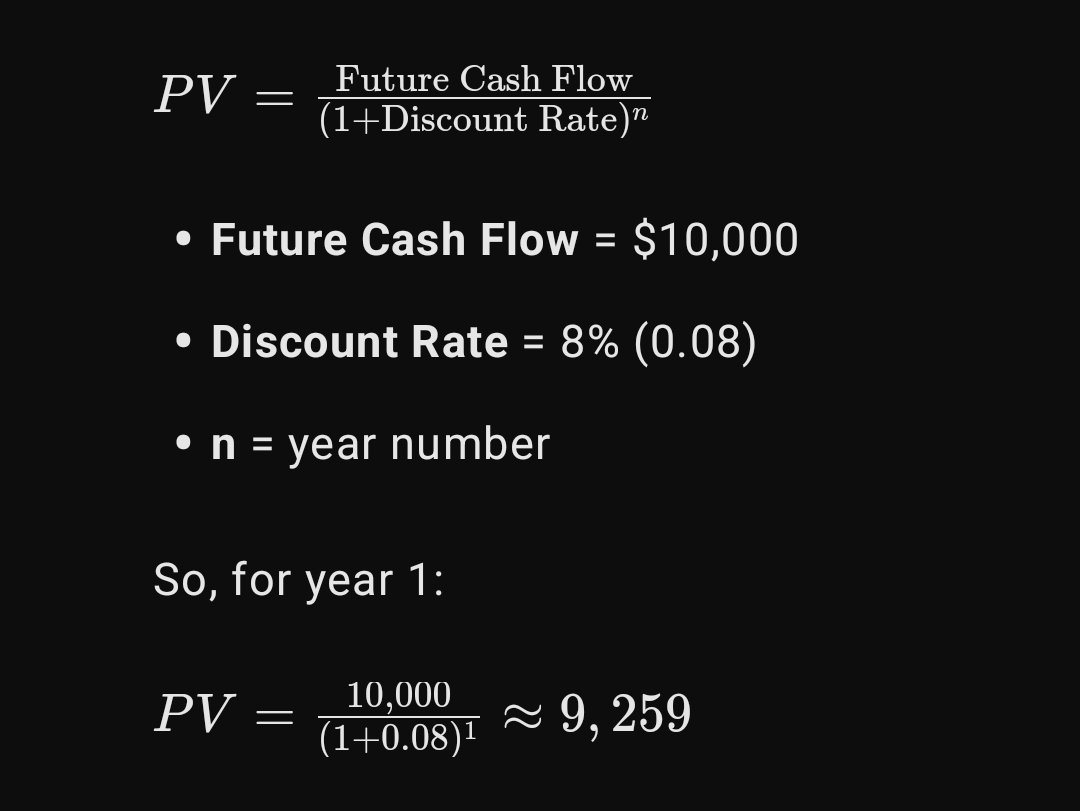

For instance, the present value (PV) of the first year's cash flow is calculated as:

PV = frac{text{Future Cash Flow}}{(1 + text{Discount Rate})^n}

Future Cash Flow = $10,000

Discount Rate = 8% (0.08)

n = year number

So, for year 1:

PV = frac{10,000}{(1 + 0.08)^1} approx 9,259

Importance of DCF:

Investment Decision Tool: Helps investors and companies determine whether an investment is worthwhile based on its potential to generate future cash flows.

Valuation Method: Widely used to value businesses, projects, or assets, giving an intrinsic value that isn’t influenced by market conditions.

Risk Assessment: By adjusting the discount rate, DCF can reflect the level of risk associated with future cash flows, helping in risk management.

Steps/Procedures for DCF Calculation:

Estimate Future Cash Flows: Forecast the expected cash flows from the investment over its life.

Select a Discount Rate: Choose a discount rate, often based on the cost of capital or required rate of return, to reflect the risk and opportunity cost.

Calculate Present Value: Use the DCF formula to discount each cash flow to its present value.

Sum the Present Values: Add up all the present values to get the total value of the investment.

Compare with Investment Cost: If the DCF value is higher than the cost of the investment, it may be considered a good opportunity.

Example in Practice:

If a company wants to acquire a new piece of equipment that costs $50,000 and expects to generate additional annual cash flows of $15,000 for 4 years, the DCF method would help determine whether the investment is financially sound. If the present value of these cash flows exceeds $50,000 at the chosen discount rate, the investment would be worthwhile.

DCF is crucial because it provides a way to make informed investment decisions based on the time value of money and the risk associated with future cash flows.

Discounted Cash Flow (DCF) is a valuation method that calculates the present value of expected future cash flows using a discount rate to account for the time value of money, helping determine the attractiveness of an investment.